Best Cruise Travel Insurance Plans of February 2024

(Updated Feb 2024) Here are the best plans to cover your cruise, plus everything else you need to know about cruise travel insurance

8 March 2022

Looking for the best cruise travel insurance for your upcoming trip?

Your search ends here. Our complete guide features the best cruise travel insurance plans. But we’re not just going to give you a travel insurance for cruise recommendation. We’re going to walk you through everything else you need to know about insuring your cruise. You’ll learn about the various types of coverage – including trip interruption coverage, medical emergency coverage, and much, much more.

Cruises are one of the most insured types of trips because this style of travel comes with unique risks. In fact, over 75% of cruisers buy travel insurance for their trip, versus about 40% of travelers in general.

What are these cruise-specific risks? You might have connecting flights to catch the departing ship. Your cruise could be during hurricane season. When you’re on the cruise you will be far from hospitals. Cruise companies also have strict cancellation rules. These policies put your trip expenses at risk if you need to cancel. This is the beauty of purchasing cruise travel insurance – you gain peace of mind knowing that in a worst case scenario, you aren’t out the thousands of dollars you spent on the adventure.

Before we unveil the best cruise insurance companies and plans of the year, we want to talk about the type of coverage we recommend you get.

Criteria for cruise travel insurance coverage

I recommend the following standards for choosing a plan, and will expand on each at the end of the guide. These criteria are mandatory for my picks:

- Trip cancellation includes Covid coverage

- Emergency medical includes Covid coverage

- Emergency medical coverage is $100,000 min.

- Medical evacuation coverage is $250,000 min.

- ‘Cancel for any reason’ available

I recommend the above criteria, and my picks meet these standards. The following criteria are good to have if possible. I factor these into my choices:

- Hurricane & weather cancellation coverage includes NOAA hurricane warnings

- Hurricane & weather coverage triggers at 12 hours or less

- Itinerary Change coverage included

- Missed Connection coverage included

Now, we’ll talk you through the importance of various types of travel insurance coverage for cruises later on. Right now, we’re excited to unveil the best cruise insurance plans of the year for travelers just like you. We’ll start off with a recommendation for most travelers:

Best cruise travel insurance for most travelers

This is my top cruise plan based on the criteria above, individual plan features, and cost. Below I have also selected a best plan for families and seniors. All recommended plans are from A.M.Best Rated reputable companies that specialize in travel insurance.

What makes this the best overall plan? This plan covers hurricane warnings, while many plans don’t. It has missed connection coverage to help you “catch up” to your ship. It has itinerary change coverage if unexpected changes happen. It has the option for Cancel For Any Reason coverage, which has become very popular since Covid. Finally, it is fairly priced so you get good value for the money.

Classic

- Covid covered for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 12 hour common carrier delay

- Includes itinerary change coverage

- Very good Missed Connection coverage $2,500/person after 3 hour delay

- Great for: Best overall plan. This plan has cruise-specific coverage like Missed Connection, Itinerary Change, and hurricane warning coverage that makes it stand out.

Example quote $232 (includes all travelers): For the above plan, the example trip includes 2 travelers (45, 45) on a 7-day cruise with airfare, with a total trip cost of $3,500).

Best cruise insurance for families

This is the best cruise insurance for parents traveling with children. Families will have extra concerns to consider, and this plan covers families better at a good price. Again, all recommendations are from reputable companies that specialize in travel insurance.

What makes this the best plan for families? This plan covers hurricane warnings, while many plans don’t. It covers school year extension for cancellations, for something like extra school to make up for snow days. It has missed connection coverage to help you “catch up” to your ship. It has the option for Cancel For Any Reason coverage, which has become very popular since Covid. Finally, the pricing is very good when traveling with children under 18.

Worldwide Trip Protector

- Covid covered for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 6 hour common carrier delay

- Includes itinerary change coverage

- Missed Connection coverage $500/person after 3 hour delay

- Unique family-friendly coverage for cancellation if your school year is extended unexpectedly.

- Very good value, the sample quote below is under 4% of the trip cost– well below average

- Great for: Families concerned about delays, Travel Insured has a generous delay trigger and high coverage.

Example quote $224 (includes all travelers): For the above plan, the example trip includes 4 travelers (45, 45, 12, 10) on a 7-day cruise with airfare, with a total trip cost of $6,500).

Best cruise plan for seniors

Classic

- Covid covered for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 12 hour common carrier delay

- Pre-existing conditions covered

- Includes itinerary change coverage

- Very good Missed Connection coverage $2,500/person after 3 hour delay

- Great for: The best overall pick is also great for senior travelers. The pricing is competitive in this higher premium bracket, plus it covers pre-existing conditions

Example quote $938 (includes all travelers): For the above plan, the example trip includes 2 travelers (70, 70) on a 14-day cruise with airfare, with a total trip cost of $9,000).

How much does cruise travel insurance cost?

In general, travel insurance costs between 4-10% of your insured trip cost. I chose the policies above because they met the criteria listed. The plans also had unique individual coverages and were well priced.

Here is a summary of the cost of travel insurance from the examples above:

- Best Overall Plan– TravelSafe Classic 6.6% of the trip cost

- Best Family Plan– Travel Insured WTP 3.4% of the trip cost

- Best Senior Plan– TravelSafe Classic 10.4% of the trip cost

Why is the “family” plan such a low percentage of the trip cost? Because there are more travelers the cost of the trip is spread between all travelers, and therefore the risk per traveler is reduced. This reduces the insurance company’s risk exposure.

How much travel insurance do I need for a cruise?

As we covered at the top of the page, I recommend minimum levels of emergency medical and evacuation coverage. Due to the nature of cruise trips, these higher levels provide adequate protection:

- Emergency medical coverage $100,000 min.

- Medical evacuation coverage $250,000 min.

Requirements by cruise line

With cruise lines operating again, many require unvaccinated travelers to buy medical coverage to board the ship. These are the requirements of the cruise lines and I believe they are too low. But, the cruise lines are requiring this to protect themselves.

Royal Caribbean: Travelers must have $25,000 in Emergency Medical coverage and $50,000 in Medical Evacuation coverage.

Carnival Cruise Line: Travelers must have $10,000 in Emergency Medical coverage and $20,000 in Medical Evacuation coverage.

Disney Cruise Line: Travelers departing from Florida must have $10,000 in Emergency Medical coverage and $30,000 in Medical Evacuation coverage.

What expenses can I insure?

Travel insurance covers your pre-paid, non-refundable trip expenses. This includes airfare to your port of departure, hotel at the port of departure, the cruise fare, shore excursions, organized tours, or event tickets. It is important to spend a few minutes to gather all of your trip costs to make sure you don’t miss anything. If the expense is not included in your insured trip cost, you will not be covered.

What does cruise insurance cover?

Finding the best cruise travel insurance means finding the right coverage. Every trip is different, and cruises come with their own list of risks.

Protection before you leave

Trip Cancellation Insurance

This protects your trip cost if you need to cancel or interrupt your trip for a covered reason. The most common reason people cancel is someone getting sick right before the trip. It also covers death in the family, hurricane & weather, house fire, quarantine, jury duty, terrorism, and more. The medical issues also apply to family members, so a parent getting sick and needing your care would be covered.

Cancel For Any Reason (CFAR) Coverage Upgrade

The list of covered reasons for cancellation includes most common situations. But, that list cannot include everything. Cancel For Any Reason insurance extends your cancellation coverage to “everything”. You need to cancel at least 48 hours before departure and insure your full trip cost. You also buy in time (usually within 10 days of your first trip payment). All the above best cruise travel insurance plans have CFAR as an optional upgrade.

Protection while at sea

Emergency Medical Coverage

This covers expenses for emergency medical treatment while on your trip. Your insurance from home may not cover you when you leave your home country.

Emergency Evacuation Coverage

This coverage pays for medical transportation. It includes an ambulances to the hospital, an airlift from a remote location, or a medical flight back home.

Primary medical coverage

Having Primary coverage for medical emergencies is better than Secondary coverage. It means the plan will pay first, without needing to use any other insurance you may have. With a Secondary coverage plan you would need to use any other coverage you might have first. Then you would use the travel insurance coverage. You’re covered either way, but having Primary coverage makes it easier to file a claim.

Protection throughout your trip

Travel Delays

This covers extra expenses caused by travel delays. For example, a few extra nights in a hotel, meals, or personal items.

Baggage Loss, Theft, or Damage

This covers your baggage not only on your flight, but on your entire trip. It will reimburse you for personal items and luggage if your bags are lost, stolen, or damaged during your trip.

Baggage Delay

If your baggage is delayed in reaching your destination, you might need extra cloths or personal items. This coverage reimburses you for these expenses.

Covid-19 Cruise Insurance: How is coronavirus covered?

The pandemic remains a concern for all travers, especially those traveling with children or elderly parents. The plans above cover cancellations if you get Covid-19. A doctor will need to verify that you cannot take your trip. In this case, Covid is treated like any other sickness for trip cancellation coverage.

The best cruise travel insurance plans also cover Covid for emergency medical treatment. This is important when you travel abroad where your insurance from home may not cover you.

There are many other covered reasons for trip cancellation. These include severe weather, terrorism, house fire, or a death in the family. Getting sick before your trip is the most common.

What makes cruises different than other trips?

Cruises are a different type of travel. To find the best cruise travel insurance, you need to consider some extra risks that are unique to cruises. These include hurricanes and other weather-related concerns, the harsh cancellation policies associated with cruise lines, high pre-paid expenses, and the distance to emergency medical help. We’ll break these issues down more in-depth to help you understand why travel insurance for cruises is so important.

Cruising and hurricane season

Bad weather and hurricanes affect thousands of trips every year. Many cruises go to hurricane-prone destinations, putting them more at risk. Your flight can be canceled or delayed, causing you to miss your boat.

What makes good hurricane & weather coverage?

Low time trigger for delays– Trip cancellation coverage covers common carrier (airlines) delays of a certain length of time. Some companies set this amount at 6, 12, 24, or even 48 hours. That would mean your flight would need to be delayed for 48 hours before your cancellation coverage would apply. So, the shorter this time, the better for you. I selected 12 hours or less for the criteria.

Hurricane warnings covered– This is not a common feature in most plans, which is why 2/3 of the best plans include it. This extends your coverage because you don’t actually need to be affected by the hurricane, but you can cancel your trip with full reimbursement if the NOAA issues a hurricane warning. Note: you must purchase travel insurance before the storm is named.

Missed connection coverage– This helps you catch up to your itinerary if you miss your departure for a covered reason, such as bad weather or a flight breakdown on the way to the port.

Itinerary Change coverage– This will reimburse travelers for missed events if their travel supplier changes their itinerary.

Cruise lines have harsh cancellation penalties

Cruise companies usually have the most harsh cancellation penalties of all travel suppliers. Hotels would let you cancel up until the day before, and airlines would charge a fee to change your tickets. Cruise lines would have a penalty schedule that put you on the hook for the full expense weeks before departure.

One bright side of the Covid pandemic has been the relaxing of some of these hard policies. To get travelers spending money again, travel suppliers have reduced or eliminated many of these penalties.

Even with these new policies the best you can hope for in the event of a cancellation is a voucher with the cruise line. The downside is they expire. This puts you under pressure to book another trip with the same cruise line in that time frame.

You have high pre-paid expenses

Cruises are sold as package travel experiences. This means costs like lodging, transport, and even meals are combined into a single cost. These expenses are pre-paid and non-refundable. That means you could lose your expenses if you needed to cancel.

You are far from hospitals if there’s an emergency

Cruise ships have medical care on board, but it is not a fully equipped and staffed hospital. If you have a serious issue onboard you want the proper medical care. Serious conditions include a stroke, heart attack, or appendicitis. Off the ship, you are likely in foreign locations where you would want proper medical care.

When should I buy my plan?

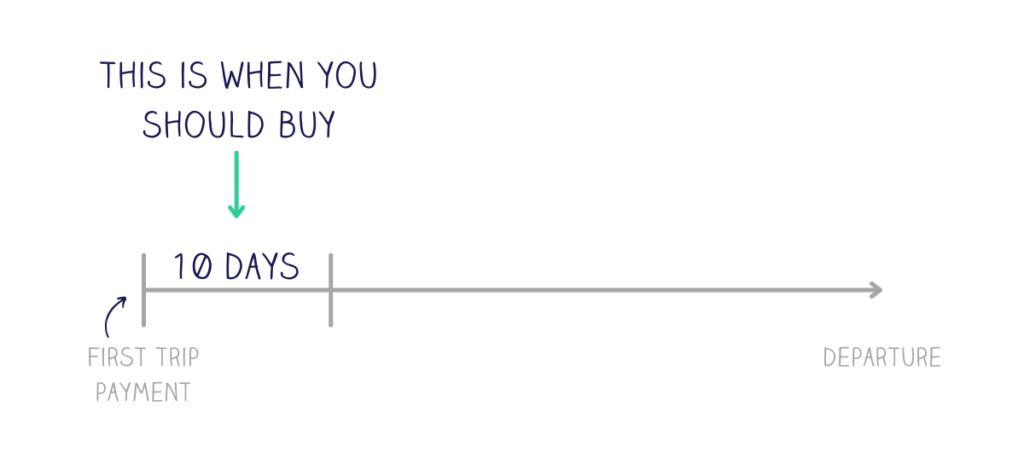

My rule: Buy travel insurance within 10 days of your first trip payment.

Some travel insurance coverage is time-sensitive. This means you need to purchase your plan soon after your initial trip deposit. This period of time is different for each company. The lowest is 10 days, and some companies are as high as 30 days.

This is why 10 days is the safest goal for you. No matter which company, 10 days will put you within that time-sensitive window.

What coverage is time-sensitive?

Cancel For Any Reason coverage (also known as CFAR) is an optional coverage with some plans. Every company that sells CFAR requires you to purchase within their time frame. If you try to purchase after this time period, you will not be able to.

Pre-existing condition coverage is time-sensitive. This does not cost extra, but many companies will cover this if you purchase at the right time.

Are these insurance companies trustworthy?

Yes. All companies featured in our review of the top travel insurance for cruises are reputable. You don’t have to take our word for it either – they are regulated by the Division of Insurance.

Zero Complaint Guarantee

Every policy purchased through CoverTrip comes with a unique Zero Complaint Guarantee.

If you are unhappy with how your travel insurance claim is handled, Squaremouth’s team of licensed claims adjusters will investigate your case and mediate with the provider on your behalf. If the complaint is not resolved to Squaremouth’s satisfaction, they will remove the provider from the website and stop selling their policies.

Cruise travel insurance FAQs

Before we wrap up our yearly review of the best cruise insurance companies and plans, we want to answer some frequently asked questions we get on this subject. If you still have questions after reading through these FAQs, don’t hesitate to reach out – we’re passionate about helping you get coverage that fits your needs and budget!

Why do I need travel insurance for a cruise trip?

A few reasons. Your pre-paid expenses for your cruise are non-refundable, and you could lose it if you needed to cancel. Cruises often take place during hurricane season, which means more opportunity for a cancellation. Cruises take you far from hospital care in the event of a medical emergency.

Is cruise travel insurance refundable?

Yes. Every travel insurance plan we sell comes with a Free Look period. This means you have a certain number of days to examine your coverage, and still have the ability to cancel for a full refund. This period is different for each company, but 10 days is a safe standard to keep in mind.

What is the cheapest cruise travel insurance company?

Most travel insurance companies have 2-3 plans at different premium levels, following the “good, better, best” pricing strategy. I tend to recommend plans in the middle level because they have great value– the right mix of coverage and pricing. Cheaper travel insurance plans will have lower coverage limits for medical, evacuation, baggage, and delays. They might also be missing some less popular coverages. We have a complete guide on the cheapest travel insurance available if you’re interested.

What is not covered by travel insurance?

Travel insurance covers sudden and unforeseen events such getting sick, a death in the family, a hurricane, theft, a house fire, and more. Therefore, if you already know you will need to file a claim you cannot purchase travel insurance to cover it. The list of exclusions also includes losses as a result of war, professional sports, some hazardous activities, drug/alcohol abuse, etc. Learn more in our in-depth discussion on what travel insurance covers.

Are cruises covered under travel insurance?

Yes, travel insurance covers cruises. Some companies market “cruise” plans, which is a collection of coverages that are important to cruise travelers.

Is travel insurance necessary for a cruise?

Yes, sort of. In the past insuring cruises insurance was popular but not necessary. For example, up to 70% of cruisers buy insurance, vs just 40% of regular travelers. But Covid has made travel insurance a requirement in many ports-of-call so it is necessary.

Can you get cruise insurance after booking?

Yes. I recommend you purchase within 10 days of your first trip payment. If you do this, you have the most options and access to coverages like Cancel For Any Reason and Pre-existing Conditions. You can purchase travel insurance right up until departure, but if something happens that causes a cancellation, you need to already have coverage purchased.

Final Thoughts On The Best Cruise Insurance Coverage

That concludes our list of the best cruise insurance plans of the year. You now know which companies and specific plans best suit your needs. More importantly, you recognize the importance of insuring your cruise. Travel insurance in general is important – but even more so when your trip involves a cruise. There are unique risks to this type of vacation that travel insurance covers. So, what are you waiting for? Enjoy peace of mind and protection by investing in quality cruise insurance coverage today! And if you want to learn more about comparing travel insurance, read our complete guide. It will help you gain confidence in making your decision.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.