The Best Travel Insurance for Covid in 2023

Travel insurance that covers Covid-19

On this page, you will see our recommendations of the best travel insurance for Covid. You will also learn everything you need to know about travel insurance Covid coverage.

Travel insurance can help with several aspects of Covid. This is why trip insurance sales have increased by 67% since the coronavirus pandemic began.

Here are the most common concerns about travel & Covid-19:

- Getting sick with Covid and needing to cancel

- A family member or travel companion getting Covid before the trip

- Catching Covid while on your trip and needing medical care

- A new surge or variant that makes you want to cancel

These are all legitimate concerns, and travel insurance can help solve them.

How can Covid-19 cause problems for travelers?

This might seem obvious, but let’s look at the ways your trip could be harmed by coronavirus/COVID-19.

You get coronavirus and are unable to travel

The is the main concern. If you get sick with Covid a week before you’re supposed to depart, you would need to cancel your trip. This would cost you whatever trip expenses are not refundable. This would also apply to a family member, traveling companion, or a parent that requires your care. Even if you thought you could travel, many countries are still requiring negative tests for entry.

Another variant or surge makes you too nervous to travel

The global situation seems to be getting better from a data standpoint. But what happens if we get another surge or variant? It seems OK to book a trip now, but what if things get really bad again?

You get coronavirus while traveling and need medical care

If you get sick while traveling, you might need medical care. In your home country, your health insurance from home will likely provide coverage for you. However, if you are traveling abroad your insurance from home might not cover you. Even if it does, it could come with coverage limits or deductibles that will cost you money.

You are quarantined because of coronavirus

Many countries require a negative test before you can come back home. If you test positive, you will need to quarantine at your trip destination while you wait. This will cost you more money with hotel stays and meals.

You get coronavirus while traveling and need to be transported home

If you are on a trip, get sick with Covid, and then need to be medically transported home, that cost could easily be $50,000+. This would add a huge financial crisis to a medical crisis. See our review of trip interruption coverage.

How does travel insurance cover coronavirus?

Important note: Trip cancellation coverage has a long list of “Covered Reasons” for cancellation, but fear of getting sick is not one of them. Standard travel insurance would not cover canceled trips because you are worried about getting Covid. Below we’ll talk about how you can cover this with Cancel For Any Reason coverage.

Most plans treat getting Covid like any other illness. You would have coverage to cancel your trip and receive reimbursement for your trip costs.

Cancelling if you are quarantined

Under standard travel insurance plans, many companies will list being under quarantine as a covered reason for cancellation.

That means if you don’t actually have Covid but are exposed and required to quarantine, you would have coverage.

Needing to quarantine while on your trip

Due to testing requirements for re-entering your home country, many travelers are getting stuck in quarantine at their trip destination.

This could be for up to 14 days, which means extra costs for hotels and meals.

Travel insurance covers this under Travel Delay coverage. This coverage pays for extra expenses like hotel and meals, up to a certain limit.

This includes things like slip and falls, food poisoning, heart attacks, and even dental emergencies in many cases. Travel insurance would help you find care and arrange payment.

If you were to get sick with coronavirus while traveling, you might need medical care…or in an extreme case need an emergency evacuation back to your home country.

Travel insurance would cover these costs.

But, you can cover cancelling out of fear is you buy a policy with the optional Cancel For Any Reason (CFAR) upgrade.

A plan with CFAR coverage lets you call off your trip for any reason of your choosing, up to 48 hours before departure, and get reimbursed for up to 75% of your insured trip cost.

Tip: If you are worried about cancelling because you are worried about getting sick with coronavirus…CFAR is your only option.

Here’s how Cancel For Any Reason (CFAR) works:

- The purchase of CFAR coverage is time sensitive. You need to buy insurance within 10 days of the date when you made any first payment towards your trip (timeframe varies by company).

- You need to insure 100% of your trip cost.

- Cancellation needs to be at least 48 hours before departure

- You can cancel for any reason and get up to 75% of your trip cost repaid to you.

After the virus started spreading, travel insurance companies had a huge influx of customers looking to buy this coverage. It even got to the point where several companies had to stop selling CFAR because it didn’t make sense economically.

Plus, COVID-19 was no longer an unforeseen risk, so it didn’t qualify as a covered reason.

However, there are still several companies that are selling travel insurance with CFAR coverage (see below).

What to look for in a COVID-19 travel insurance plan

If you are reading this page, you are looking for travel insurance but have concerns about coronavirus-related issues.

Travel insurance for coronavirus needs to cover:

- Cancellations if you get sick with coronavirus

- Canceling if you’re in quarantine

- Medical expenses if you get coronavirus while traveling

- Evacuation expenses if needed

- Quarantine at destination under Travel Delay coverage

- * Cancel For Any Reason (CFAR) coverage to cover coronavirus fears

*This is optional and is for people worried about the unknown future of the virus. My recommendation is to buy CFAR.

Option 1: Comprehensive travel insurance with Covid coverage

The following companies meet the above criteria in various ways. Not every criteria is met by every company, but they all have some sort of coverage for coronavirus concerns.

- April

- AXA

- Berkshire Hathaway*

- Cat 70

- HTH

- John Hancock

- Nationwide

- Seven Corners

- TinLeg

- Travelex*

- TravelSafe

- Trawick

- Travel Insurance Services

*Travelex & Berkshire do not have a CFAR option

It is a lot of work to visit each of these company websites to get a quote and buy, so next I will show you how to do it the easy way.

Option 2: Travel medical insurance with Covid coverage

If you do not want coverage for cancellation, interruption, delays, or baggage, another option is a Travel Medical insurance plan.

Travel Medical insurance focuses on emergency medical and evacuation coverage. This type of plan is popular with travelers leaving their home country for longer term trips, such as study abroad, expatriates, or business travel.

Seven Corners is a travel medical insurance company that has developed some plans that have named coverage for COVID-19.

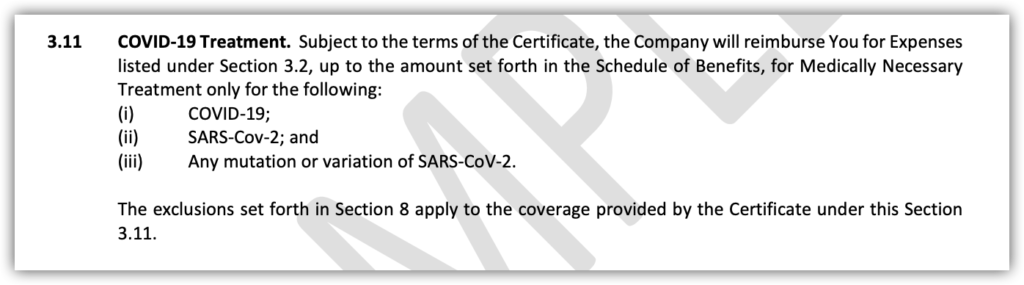

Here is a screenshot of their policy:

As you can see, they specifically list COVID-19 treatment as a coverage. Here are the plans from Seven Corners that cover this:

| POLICY NAME | WHO IT IS FOR | GET QUOTE |

|---|---|---|

| Liaison Travel Plus Travel Medical | This is a travel medical and evacuation plan, so it does not have coverage for cancellations. This is good for travelers going abroad who want coverage if they get COVID-19. (Note: some countries will start requiring proof of medical insurance, this would be the right plan for that. | Get a quote here |

| Liaison Student Plus | This is a student-focused travel medical plan for those studying abroad. Schools will likely require this as well. | Get a quote here |

| Wander Frequent Traveler Plus | This is an annual travel medical plan for people who take several trips throughout the year. | Get a quote here |

How to buy comprehensive insurance for Covid:

The easiest way to get quotes for the companies above, read more about the coverage, compare prices, and purchase online is it use a comparison engine.

Here are the steps:

- Click this link to visit our comparison tool.

- Enter your trip information

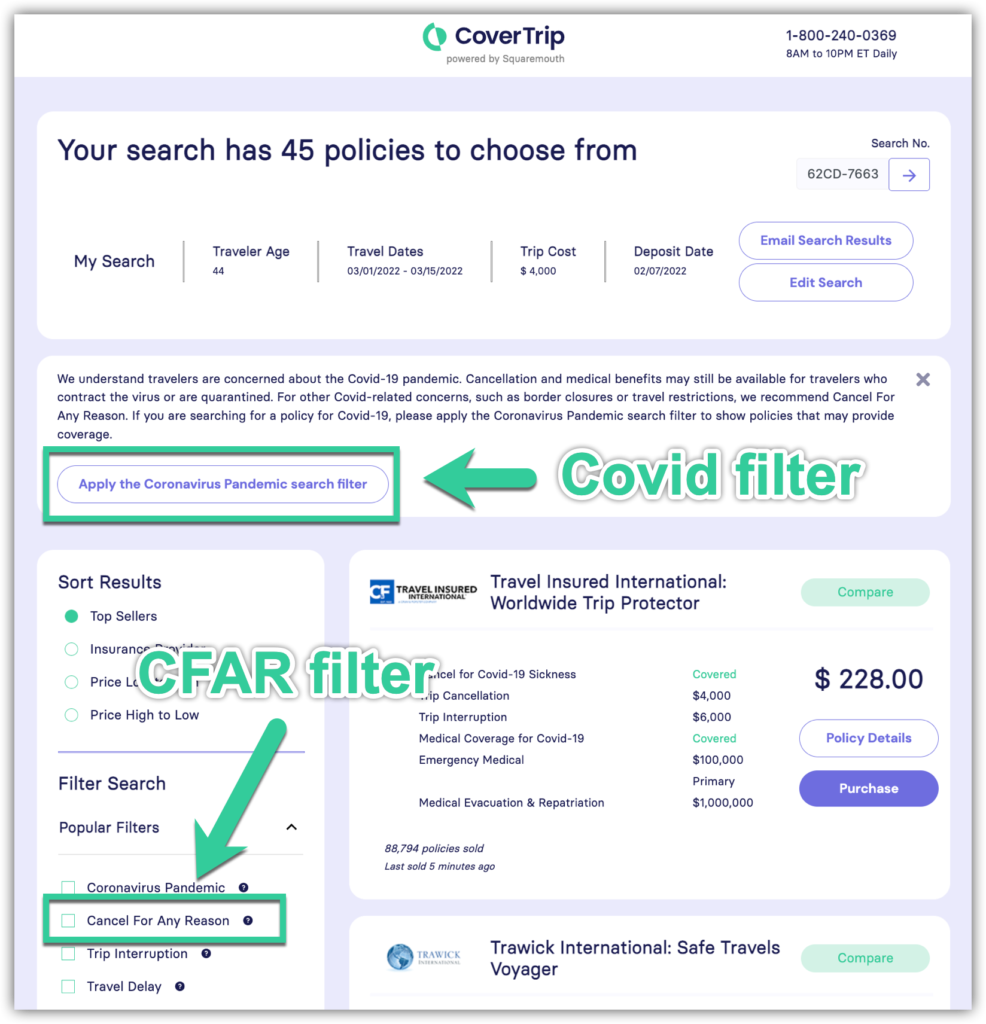

- On the results screen, select the Coronavirus Pandemic filter in the top featured section (see screenshot below)

- If you want Cancel For Any Reason coverage, there is a filter for that too on the left side

- You will then see just the plans with some sort of coronavirus coverage

- To read the specific coronavirus coverage, click the Policy Details button and a popup window will appear with details. You can exit the screen and look at other policies

- When you select a plan, click Purchase to complete enrolling online

Screenshot

Covid travel insurance FAQs

This is not a specific plan, but would include any plan that provides Covid-related coverage. Many companies provide different levels of coverage for Covid, and any of these could be called Coronavirus Travel Insurance.

Yes, most plans have some sort of coverage for Covid, including cancelling for getting Covid, needing medical care if you get Covid while traveling, or needing to quarantine.

The main coverage is for needing to cancel your trip if you, a traveling companion, or a family member gets sick with Covid. It also covers medical expenses if you get sick with Covid on your trip, extra expenses for needing to quarantine on your trip, and medical evacuation if needed.

Yes, most plans will treat Covid like any other sickness you get while traveling and provide coverage.

Yes, plans with Covid coverage will cover this under Travel Delay coverage. This is usually used when delayed for weather, but it applies to quarantines as well. This would pay a specified amount per traveler, per day.

Yes, any pre-paid and non-refundable trip cost is covered with trip cancellation insurance. This can include flights, cruise costs, tours, event tickets, and all-inclusive resort fees.

Yes, as of now there are no vaccination requirements specific to Covid and travel insurance.

Since this is the same plan as a standard Travel Insurance plan, the costs are the same. A good estimate is between 4-10% of your insured trip cost.

The Cancel For Any Reason upgrade, which is very popular for Covid, will cost an extra 40-50%.

As with all travel insurance purchases, it is best to buy as soon as possible after your first trip payment. This gives you access to time-sensitive coverage options like Cancel For Any Reason, as well as pre-existing conditions and financial default.

I always recommend buying within 10 days of your first trip payment.

Use our comparison tool to compare quotes from the best companies and buy online in minutes.

I recommend a plan from Travel Insured International called Worldwide Trip Protector.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.