Cancel For Any Reason (CFAR) Travel Insurance Coverage

Cancel For Any Reason (CFAR) is travel insurance coverage that reimburses up to 75% of your total trip costs if you have to cancel your trip.

10 March 2011

What is CFAR Travel Insurance?

Briefly: Cancel For Any Reason (CFAR) is travel insurance coverage that reimburses up to 75% of your total trip costs if you have to cancel your trip for any reason not listed in the standard coverage.

What you will find on this page:

- Coronavirus: Special Section & Tips

- How does CFAR coverage help?

- What does Cancel For Any Reason travel insurance cover?

- How does CFAR work?

- Understanding Supplier Cancellation Penalties

- Important notes about Cancel For Any Reason travel insurance

- What type of policy covers this?

- How to buy a plan with Cancel For Any Reason coverage

- FAQs about Cancel For Any Reason insurance

- Company CFAR Coverage Table

- Summary

Coronavirus: Special Section & Tips

With the continued concerns about the Coronavirus outbreak, millions of travelers are not sure what to do about travel plans.

Travel insurance can help in several ways, but it depends on the traveler, the trip, timing, and what is needed.

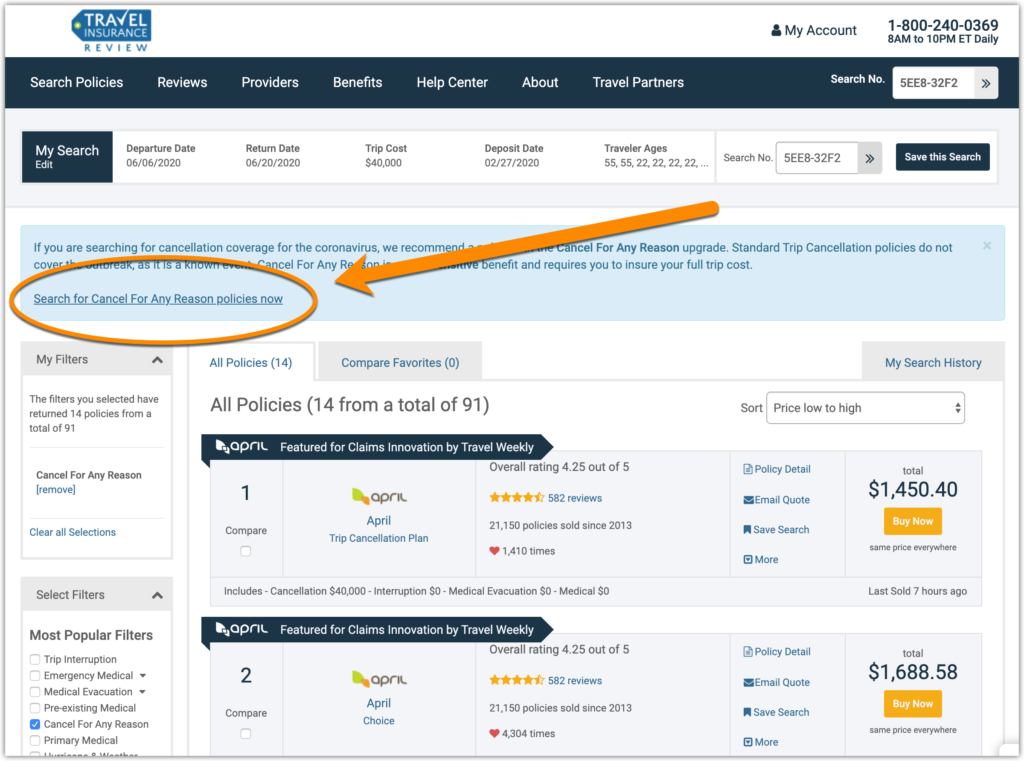

Note: If you want to buy insurance for a trip and have concerns about coronavirus, the best option is Cancel For Any Reason insurance

A standard trip insurance plan has a long list of Covered Reasons for Trip Cancellation. These include sickness, accident, death in the family, job loss, hurricane, house fire, etc.

But, the fear of getting sick is not a covered reason for cancellation. The best option is to buy a plan with CFAR coverage (see How to Get a Quote for CFAR Coverage below).

How coronavirus & travel insurance works

Here is the current situation for different travelers:

| YOUR SITUATION | HOW CORONAVIRUS WORKS WITH IT: |

|---|---|

| Not Insured but planning to travel | The only option would be a plan with Cancel For Any Reason (CFAR) coverage. You need to meet the criteria and purchase soon. How to buy: Use a comparison tool like Squaremouth and filter plans with CFAR coverage (see How To below for a handy tip to save time shopping) |

| Insured before 1/21/2020* and planning to travel | You might have coverage under Trip Cancellation and Trip Interruption, contact your insurance company with any claims. You would also have coverage for Emergency Medical and Evacuation coverage as necessary. |

| Insured after 1/21/2020* and planning to travel | No coverage under Trip Cancellation since the even was no longer unforseen, but still coverage for Emergency Medical and Evacuation coverage as necessary. |

| Insured and traveling | You might have coverage under Trip Cancellation and Trip Interruption depending on your date of purchase, contact your insurance company with any claims. You would also have coverage for Emergency Medical and Evacuation coverage as necessary. |

| Not Insured and traveling | You would have no travel medical insurance coverage |

*1/21/2020 is the date Coronavirus was declared as an event, and no longer meets the insurable requirement of being “Unforeseeable”.

How to get a quote for CFAR coverage

- Use the orange Quote button below to use our comparison engine

- Enter trip details

- Filter for plans with CFAR (if you use the button below it will apply it automatically)

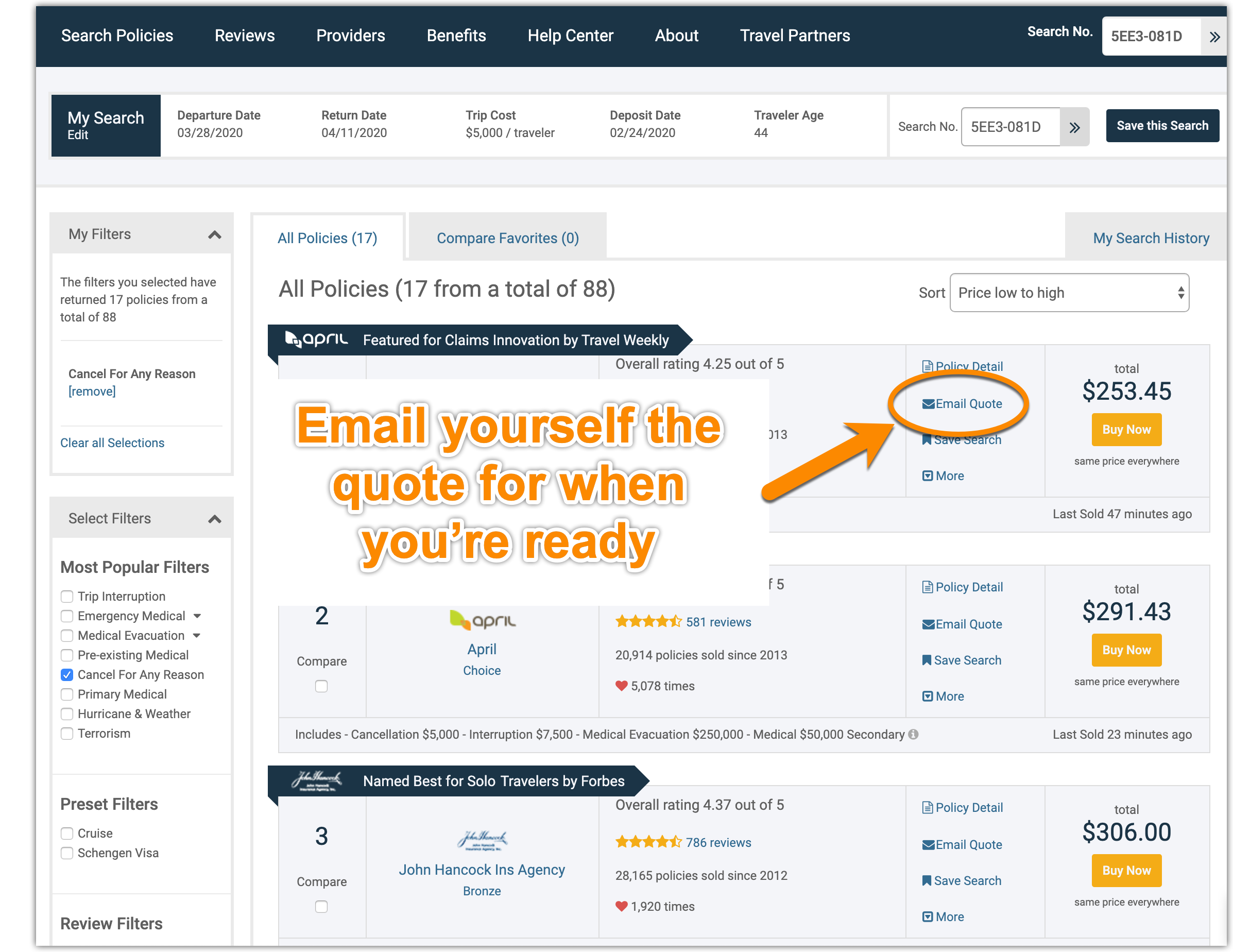

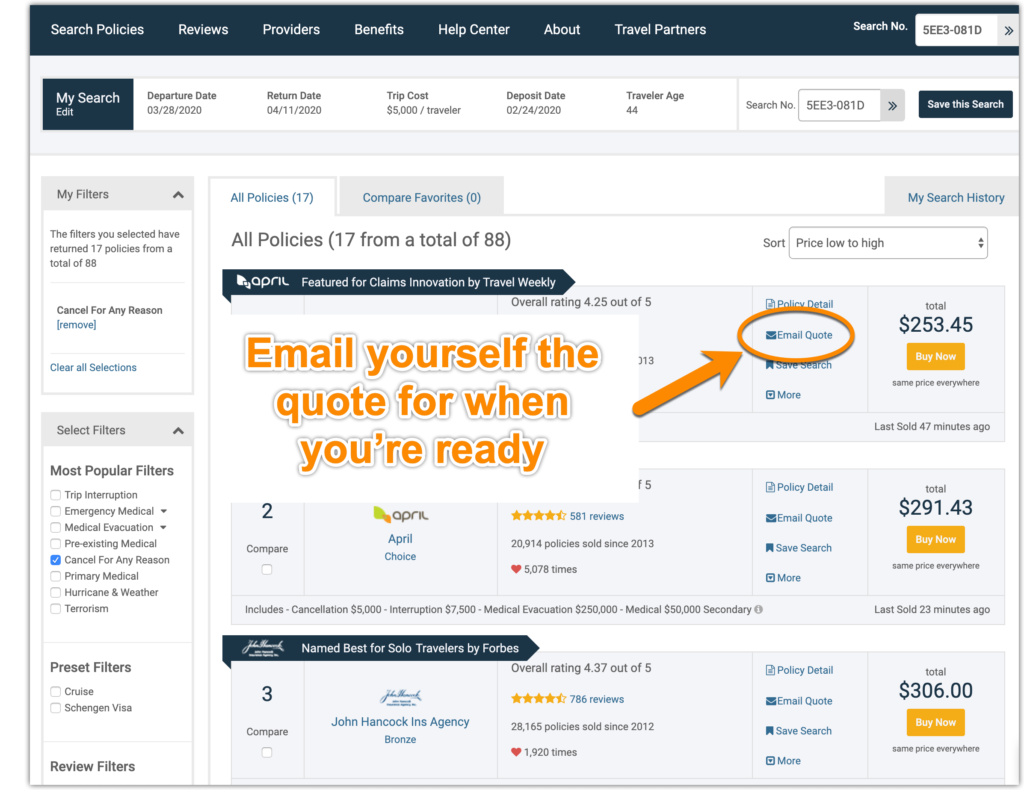

- Email yourself the quote to save your work if you’re still researching

- Buy when ready (CFAR is time sensitive and needs to be purchase within 21 days if initial trip deposit, sooner is better)

Quote Tip #1: The button below will automatically filter for CFAR plans, or you can use the filter on the results screen

Quote Tip #2: Don’t lose your work, email quote to yourself to retrieve later

Get a quote for CFAR plans now. The CFAR filter will be automatically applied

-END Coronavirus Special Section-

How does CFAR coverage help?

Example story:

Jennifer and her friends from college had long planned a tour of the pyramids and monuments of Egypt. On Jennifer’s 50th birthday, they decided the time had come. So they scheduled flights into Cairo and purchased a package tour.

Just three weeks before their scheduled departure, however, news of political unrest and reports of rioting, looting, and gunfire flashed across their televisions. The U.S. State Department orders non essential personnel and their families to leave the country.

Trip cancellation coverage does not apply to situations of political unrest.

But, by having Cancel For Any Reason travel insurance their travel policies meant that Jennifer and her friends could recover their costs and wait for a safer time to travel.

What does Cancel For Any Reason travel insurance cover?

This coverage provides reimbursement (up to the covered amount) for non refundable trip payments and pre-paid trip deposits if you have to cancel your trip for any reason not covered under the trip cancellation benefit.

This benefit is separate and different from trip cancellation coverage.

‘Cancel for any reason’ coverage is considered a ‘fail-safe’ by many travel insurance buyers who worry they may have to cancel their trip for a reason that is not covered by trip cancellation coverage and want to recover at least a portion of their expenses.

How does CFAR work?

- Buy Early- To be eligible for a CFAR plan, you need to purchase within the required number of days of your initial trip deposit date (usually up to 21 days)

- Get a quote- Get comparison quotes (How-To is below) and filter for plans with CFAR coverage

- Insure total trip cost- For CFAR to be valid you need to insure 100% of your pre-paid and non-refundable trip costs

- Cancel on time- You also need to cancel the trip within the policy guidelines, usually at least 48 hours prior to the trip

Understanding Supplier Cancellation Penalties

A cancellation penalty is the amount the travel supplier will not refund you if you have to cancel your trip.

The cancellation penalty determines the percentage that travel insurance will reimburse less the amount refunded by your travel supplier.

Using the above story as our example:

- Jennifer’s trip cost $5,000 and tour operator imposes a 50% cancellation penalty if the cancellation occurs no less than two weeks prior to departure.

- Jennifer cancels and is penalized 50%, or $2,500, by the tour operator who agrees to refund half her trip cost.

- Jennifer’s travel insurance penalty schedule provides 90% reimbursement if the penalty amount is up to 50% of the trip cost.

Thanks to her ‘cancel for any reason’ coverage, Jennifer’s reimbursement looks like this:

| Total trip cost | $5,000 |

| Subtract amount penalized by travel supplier (50%) | – $2,500 |

| Amount covered by ‘Cancel for any reason’ (75% of penalty amount) | – $1,875 |

| Jennifer loses only | $625 |

Important notes about Cancel For Any Reason travel insurance

- ‘Cancel for any reason’ coverage may be included with trip cancellation coverage or it may be a selectable option that has to be added to a policy (for an additional fee).

- This coverage requires purchase within a certain number of days of making your initial trip deposit (see table below).

- The cancellation must occur not less than a defined number of days or hours prior to the scheduled trip departure (see table below).

- You must insure 100% of all pre-paid travel arrangements that are subject to cancellation penalties or restrictions by the travel supplier.

- A few plans have maximum per-person trip cost limits. Specifically, CSA’s Custom Luxe plan limits the per-person trip amount to $10,000.

- Any amounts that are refunded by the travel supplier will be deducted from the amount refunded by your travel insurance plan.

What type of policy covers this?

This coverage is exclusively provided in package plans, and not medical plans.

Also, it’s usually an optional coverage that must be selected and added to your travel insurance policy (for an additional fee). Not all travel insurance plans offer this coverage option.

A few plans include ‘cancel for any reason’ automatically:

- The Worldwide Trip Protector Plus plan by Travel Insured

- The Premier plan by TravelSafe

How to buy a plan with Cancel For Any Reason coverage

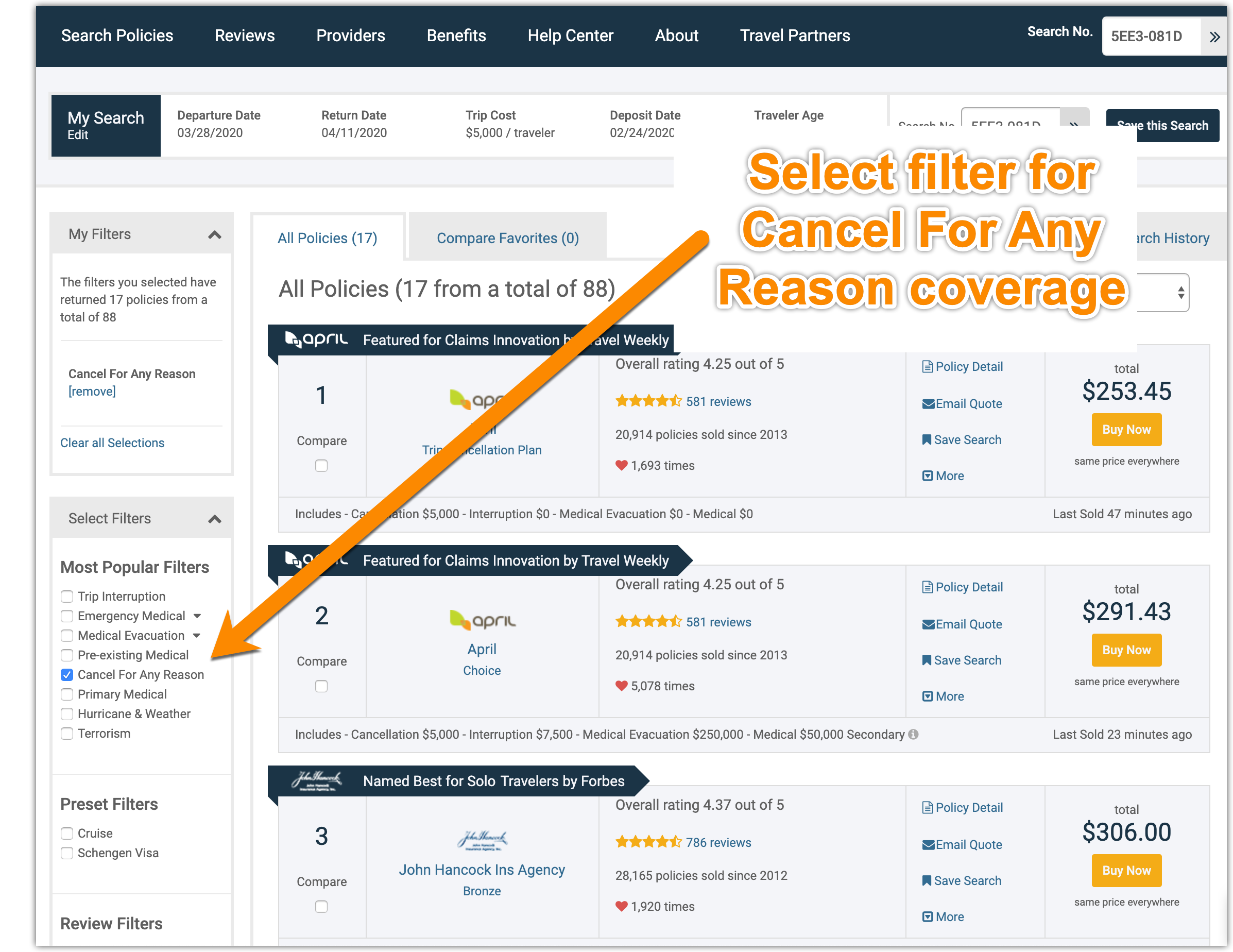

Use our comparison engine to get quotes for all plans, then filter for plans with the Cancel For Any Reason coverage.

How to buy Cancel For Any Reason insurance

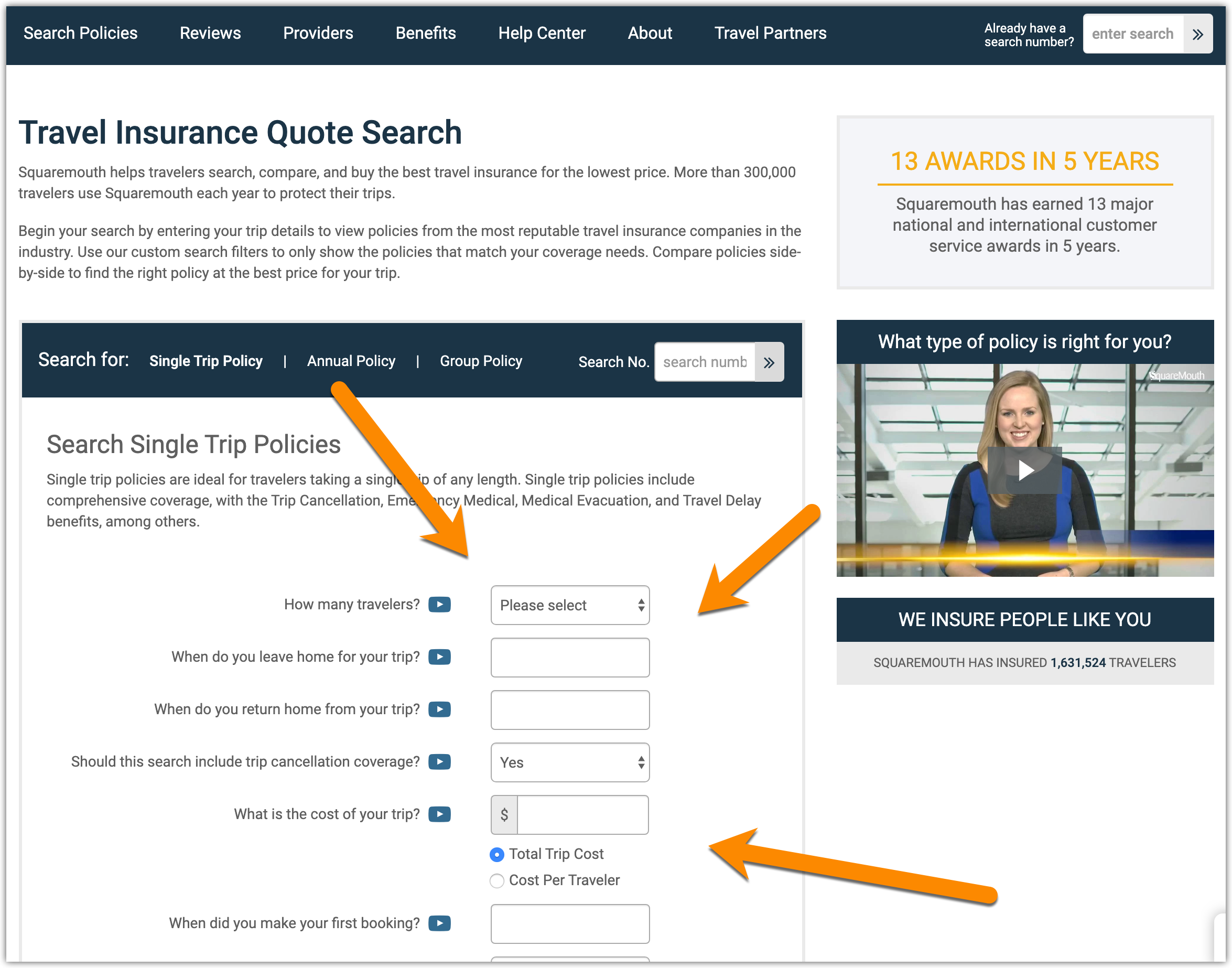

- Visit the link below to our comparison tool. Use our Comparison Tool Here to get started.

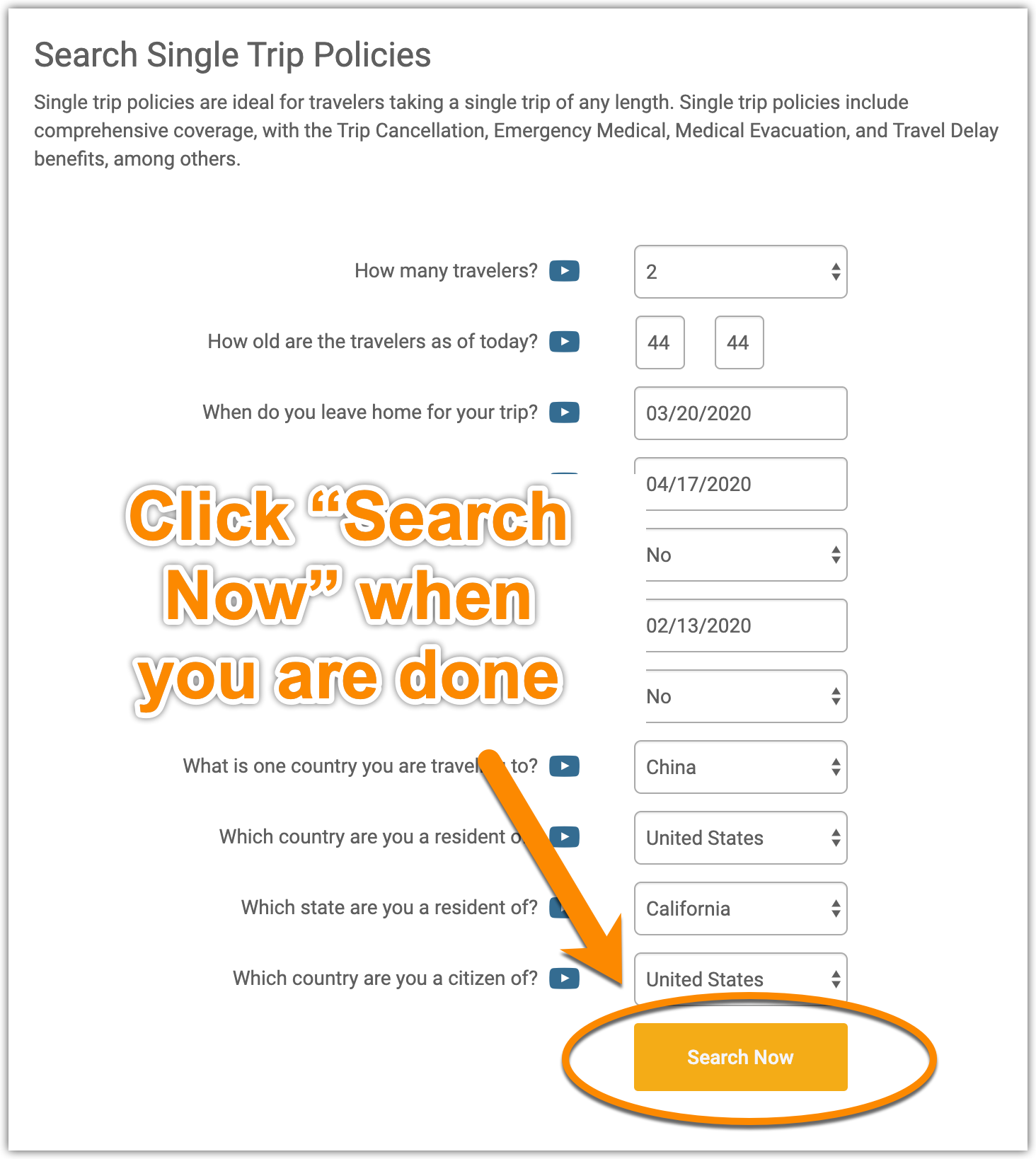

- Enter your trip details. Enter your trip information on this screen to start your travel insurance search. The main screen has areas to enter your trip information, including traveler ages, trip dates, trip cost, deposit date, destination, and residency.

- When you are finished click the “Search Now” button. On the nest screen, you will see all the plans available to you.

- Filter for plans with Cancel For Any Reason. Check the Cancel For Any Reason filter on the left side to see only plans with this coverage.

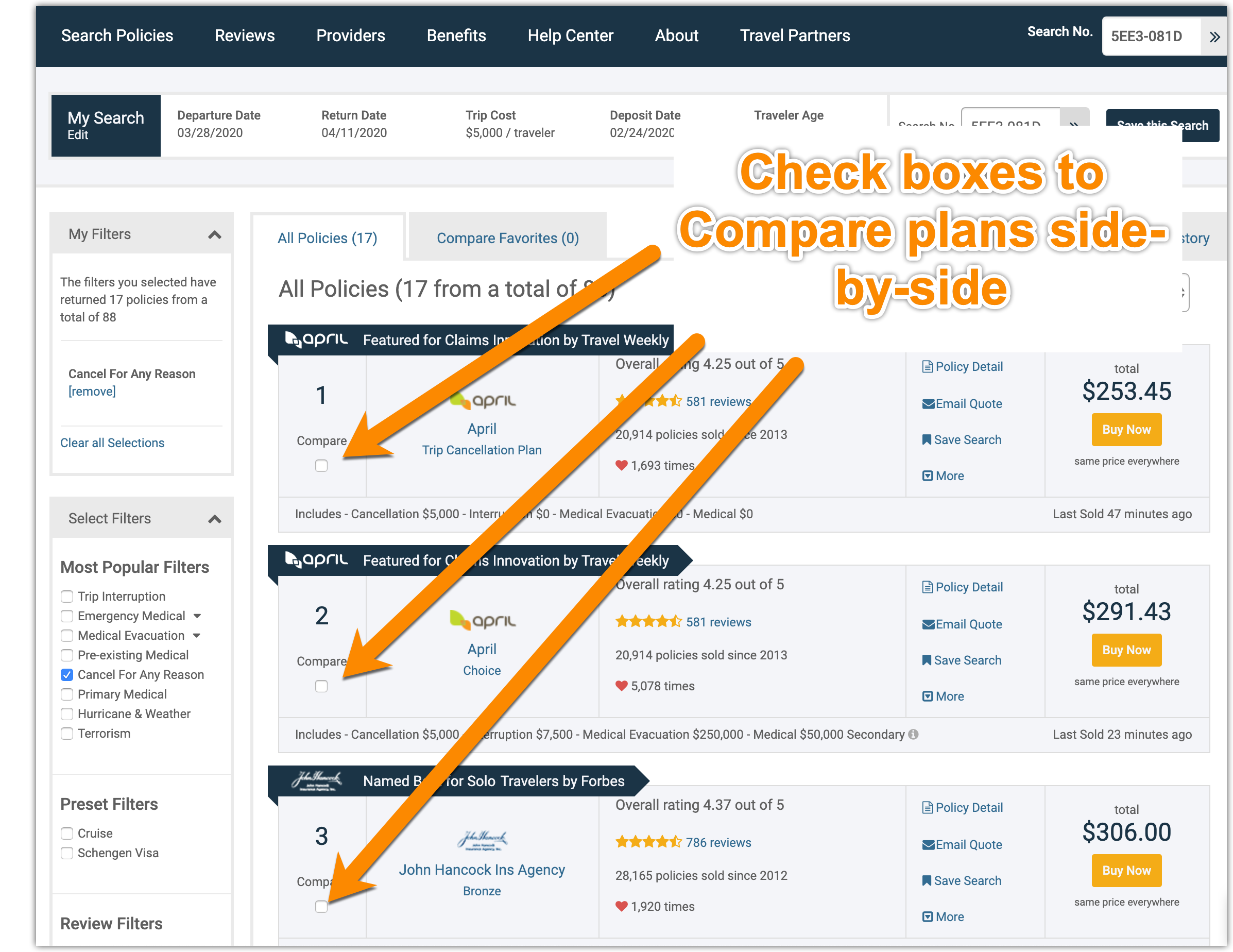

- Compare available plans. You can select several plans and compare them side-by-side to see the other coverages.

- Time-saving Tip: Email yourself the quotes for later. If you’re still shopping around, make it easier to continue and send the quote to yourself by email. The email will have all the quotes, with links to get back into this page and finish.

- Complete purchase. When you have selected a plan, click the Buy Now button and complete the information. You will receive an email confirmation immediately.

Get a quote for CFAR plans now. The CFAR filter will be automatically applied

FAQs about Cancel For Any Reason insurance

Are Coronavirus-related cancellations covered?

Yes, CFAR can cover cancellations related to Covid-19 coronavirus, but see purchase details above.

How does Cancel for Any Reason (CFAR) work?

The criteria for buying CFAR insurance are 1) Buy within the required time of initial trip deposit, usually 21 days. 2) Insure 100% of the trip cost. 3) Cancel within 48 hours of the departure

How much does Cancel for Any Reason insurance cost?

The CFAR upgrade usually adds 40-50% to some insurance plans’ cost. However, April Choice offers very low CFAR coverage because their purchase window is so small at 24 hours from initial trip deposit. (you can get April Choice quotes using the orange Quote buttons)

Can I really cancel for ANY reason?

Yes. As long as you meet the policy requirements you can call off the trip for any reason.

How much does CFAR reimburse?

The standard with most plans is to cover up to 75% of the insured trip cost if you cancel your trip.

Company CFAR Coverage Table

| POLICY | COMPANY | IF PURCHASED WITHIN * | POLICY LIMIT ** | PENALTY SCHEDULE | CANCEL WITHIN |

|---|---|---|---|---|---|

| No coverage | Allianz | ||||

| Custom Luxe | CSA | 24 hours | 75% | 48 hours | |

| No coverage | FrontierMEDEX | ||||

| Global Alert Preferred | Global Alert | 15 days | 75-100% of loss | See penalty schedule | 2 days |

| Global Alert Preferred Plus | Global Alert | 15 days | 90-100% of loss | See penalty schedule | 2 days |

| No coverage | Global Underwriters | ||||

| No coverage | HTH Worldwide | ||||

| Advantage Asset | MH Ross | 15 days | 75% of loss | No penalty schedule | 2 days |

| Advantage Complete | MH Ross | 15 days | 90-100% of loss | See penalty schedule | 2 days |

| Advantage Bridge | MH Ross | 15 days | 80-100% of loss | See penalty schedule | 2 days |

| RoundTrip Choice | Seven Corners | 10 days | 75% of loss | No penalty schedule | 2 days |

| Tee, Tour, and Travel | Travel Guard | 15 days | 50% of loss | No penalty schedule | 2 days |

| My Travel Guard | Travel Guard | 21-30 days | 50-75% of loss | No penalty schedule | 2 days |

| Sportsman’s Travel | Travel Guard | 15 days | 50% of loss | No penalty schedule | 2 days |

| Adventure Travel | Travel Guard | 15 days | 50% of loss | No penalty schedule | 2 days |

| Platinum | Travel Guard | 15 days | 70% of loss | No penalty schedule | 2 days |

| Gold | Travel Guard | 15 days | 50% of loss | No penalty schedule | 2 days |

| Select Plus | Travel Insurance Services | 15 days | 75% of loss | No penalty schedule | 2 days |

| Select Elite | Travel Insurance Services | 21 days | 75% of loss | No penalty schedule | 2 days |

| Select Basic | Travel Insurance Services | 15 days | 75% of loss | No penalty schedule | 2 days |

| Worldwide Trip Protector | Travel Insured | 21 days | 75% of loss | No penalty schedule | 48 hours |

| Worldwide Trip Protector Gold | Travel Insured | 30 days | 75% of loss | No penalty schedule | 48 hours |

| No coverage | Travelex | ||||

| Vacation Classic | TravelSafe | 15 days | 75-100% of loss | See penalty schedule | 2 days |

* If purchased within the specified amount of time after the initial trip deposit.

** Subject to cancellation penalty schedule

*** Optional coverage

Is it Mandatory to have CFAR Travel Insurance?

Not, it’s not mandatory but CFAR is the most popular reason that travelers buy travel insurance. Every once in a while, life throws a curveball. And Cancel For Any Reason coverage offers the most cancellation flexibility.

Cancel for any reason (CFAR) is an optional benefit, so you don’t have to buy it.

It’s also the only coverage option that covers the fear of trip cancellation. It’s also the only coverage that lets you bypass the covered reasons for canceling.

Summary

- Considered by many travelers as a ‘fail-safe’ if they have to cancel for a non covered reason

- 100% of pre-paid travel arrangements that are subject to cancellation penalties must be insured

- Some plan benefit are subject to cancellation penalty schedules

- The cancellation must occur not less than the number of days defined in the policy

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.