The Best Travel Insurance Plan in April 2025

My top pick right now is FlexiPAX from Travel Insured International, excellent coverage, reputable company, and great value.

25 March 2022

This page will show you the best travel insurance plans right now, and why they’re the best choice for your trip.

Sorting through up to 104 different policies from 22 providers is a lot of work. I have read the small print, compared plans, and chosen the best.

Why listen to me?

My name is Damian Tysdal, and I’m a licensed insurance agent (MA #1883287). I read the fine print so you don’t have to. Most other websites about travel insurance are from “writers” who may cover finance and insurance, but I have been a licensed travel insurance agent since 2006.

Travel insurance protects your money if you need to cancel your trip. It also covers emergency medical costs, travel delays, lost baggage, baggage delays, and more.

Criteria for my best travel insurance picks

I recommend the following minimum standards for your travel insurance plan, and will expand on each at the end of the guide. These criteria are mandatory for my picks:

- Cancellation covered for sickness (most common reason for canceled trips)

- Medical emergency covered for Covid

- Emergency medical coverage is $100,000 min.

- Medical evacuation coverage is $250,000 min.

- ‘Cancel For Any Reason’ available (aka CFAR)

- Pre-existing conditions waiver available

I recommend the above criteria, and my picks meet these standards. The following criteria are good to have if possible. I factor these into my picks for best travel insurance plans:

- Hurricane & weather cancellation coverage includes NOAA hurricane warnings

- Hurricane & weather coverage triggers at 12 hours or less

- Medical coverage is Primary (vs Secondary)

About the best travel insurance picks

On this page, I have selected a best overall plan for most travelers. I used to have selections for specialty concerns like cruises, seniors, families, seniors, and budget-minded travelers…but a single plan has come out on top for all of these concerns. Also, any plan I recommend is from an A.M. Best Rated reputable company that specialize in travel insurance.

Best Travel Insurance Overall

This is my top travel insurance plan based on the criteria above, individual plan features and cost. It meets all the required criteria above, and all of the “good to have” criteria as well.

If I had to choose a single plan to recommend for most travelers, this is it. It combines right coverage, high coverage limits, specialty coverages, fair pricing, and they’re a reputable company that pays claims.

Worldwide Trip Protector- FlexiPAX

- Coverage for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 6 hour common carrier delay

- Children 17 and under included free

- Unique family-friendly coverage for cancellation if your school year is extended unexpectedly.

- Great for: Overall best plan. This plan has better coverage in almost areas, unique coverages, and is priced competitively.

What does travel insurance cover?

Finding the best travel insurance means finding the right coverage at the right price. I’ve mentioned several coverages above, and will explain them more here:

Protection before you leave

Trip Cancellation Insurance

This protects your trip cost if you need to cancel your trip. There is a long list of covered reasons for trip cancellation. The most common reason people cancel is someone getting sick right before the trip. It also covers death in the family, hurricane & weather, a house fire, quarantine, jury duty, terrorism, and more. The medical issues also apply to family members, so a parent getting sick and needing your care would be covered.

Cancel For Any Reason (CFAR) Coverage Upgrade

The list of covered reasons for cancellation includes most common situations. But, that list cannot include everything. Cancel For Any Reason insurance extends your cancellation coverage to “everything”.

You need to cancel at least 48 hours before departure and insure your full trip cost. You also buy in time (usually within 10 days of your first trip payment).

This upgrade has become very popular since the start of Covid, and I think it’s an important option to have. All the above best travel insurance plans have CFAR as an optional upgrade.

Protection while on your trip

Emergency Medical Coverage

This covers expenses for emergency medical treatment while on your trip. This could be something like a slip and fall, a stroke, food poisoning, and more.

Your insurance from home may not cover you when outside your home country. Medicare never covers outside the USA. Healthcare in foreign countries varies in how they handle expenses. Some will not let you leave the hospital until you pay the bills.

Emergency medical coverage pays any expenses up to the policy limit.

Emergency Evacuation Coverage

This coverage pays for medical transportation if you need it. It includes an ambulances to the hospital, an airlift from a remote location, or a medical flight back home. These expenses can easily be over $100,000. Even if your insurance from home covers medical expenses, it won’t cover evacuatuon.

Protection throughout your trip

Trip Interruption

This covers your unused trip costs if your trip is cut short. The list of reasons is similar to Trip Cancellation coverage. For example: Three days into your trip, your mother has a stroke and needs your assistance. You skip the rest of your trip and catch a flight back home. Insurance would reimburse the portion of the trip you missed, and any extra expenses like the last-minute flight home

Travel Delays

This covers extra expenses caused by travel delays. If severe weather or flight delays cause you to get stuck at your destination, it would pay for a few extra nights in a hotel, meals, or personal items.

This is the coverage that would pay extra expenses if you are required to quarantine for Covid-19.

Baggage Loss, Theft, or Damage

This covers your baggage not only on your flight, but on your entire trip. It will reimburse you for personal items and luggage if your bags are lost, stolen, or damaged during your trip.

Baggage Delay

If your baggage is delayed in reaching your destination, you might need extra cloths or personal items. This coverage reimburses you for these expenses.

24/7 Assistance

This is the lifeline you call with any problems. The insurance company can help arrange medical care, transportation, overcome language barriers with a translator, arrange payment, and more.

Coverage details that make a big difference

Travel insurance policies have coverage and coverage limit– but there are more details to look for when finding the best travel insurance plans. Here are a few things I look for that makes some plans better than others:

Primary vs Secondary medical coverage

Having Primary coverage for medical emergencies is better than Secondary coverage. It means the plan will pay first, without needing to use any other insurance you may have. With a Secondary coverage plan you would need to use any other coverage you might have first. Then you would use the travel insurance coverage. You’re covered either way, but having Primary coverage makes it easier to file a claim.

Pre-Existing Conditions Coverage

Some policies have better coverage for pre-existing medical conditions. This one gets confusing, so I’ll walk through it step-by-step:

1- You can’t buy insurance to pay for something you already have, so insurance companies exclude pre-existing conditions.

2- Since many people have some sort pre-existing condition, insurance companies define a “look-back” period. For example: If a medical condition did not arise in your 180 day look-back period, you would be covered.

3- Some policies waive the look-back period if you purchase soon after your first trip payment

This is a “nice to have” coverage because it provides better protection.

Hurricane & Weather Coverage

Bad weather and hurricanes affect thousands of trips every year. Many trips and cruises go to hurricane-prone destinations, putting them more at risk. Your flight can be canceled or delayed, causing you to miss your boat.

What makes good hurricane & weather coverage?

Low time trigger for delays– Trip cancellation coverage covers common carrier (airlines) delays of a certain length of time. Some companies set this amount at 6, 12, 24, or even 48 hours. That would mean your flight would need to be delayed for 48 hours before your cancellation coverage would apply. So, the shorter this time, the better for you. I selected 12 hours or less for the criteria.

Hurricane warnings covered– This is not a common feature in most plans, which is why 2/3 of the best plans include it. This extends your coverage because you don’t actually need to be affected by the hurricane, but you can cancel your trip with full reimbursement if the NOAA issues a hurricane warning. Note: you must purchase travel insurance before the storm is named.

What is the average cost of travel insurance

The average cost of travel insurance is between 4-10% of your insured trip cost. Based on the latest actual sales data, here is what travelers are spending on travel insurance, their overall trip, and the length of the trip:

- Average premium: $225.79

- Average trip cost: $5,010.37

- Average trip length: 17 Days

What is the cost of travel insurance based on?

The cost of travel insurance is based on the following factors:

- Cost of trip

- Ages & number of travelers

- Length of trip

- Coverage limits

- Optional upgrades

- Coverage details

The main factor in travel insurance cost is the trip cost. The more expensive the trip, the more risk the insurance company has if they need to reimburse you.

Older travelers will have higher premiums because of the additional risk of medical issues. Longer trips will cost more because there is more time for something to happen.

High policy limits for medical coverage will cost more than lower policy limits.

Upgrades like Cancel For Any Reason cost more. And finally, details like Primary medical and hurricane warning coverage tend to be part of more expensive plans.

What expenses can I insure?

Travel insurance covers your pre-paid, non-refundable trip expenses. This includes can include:

- Airfare

- Hotel

- Cruise costs & shore excursions

- Organized tours

- Event tickets

- Airbnb rentals

- Car rentals

As long as your expense is pre-paid and non-refundable, it can be included in your insured trip cost.

It is important to spend a few minutes to gather all of your trip costs to make sure you don’t miss anything. If the expense is not included in your insured trip cost, you will not be covered.

When should I buy travel insurance?

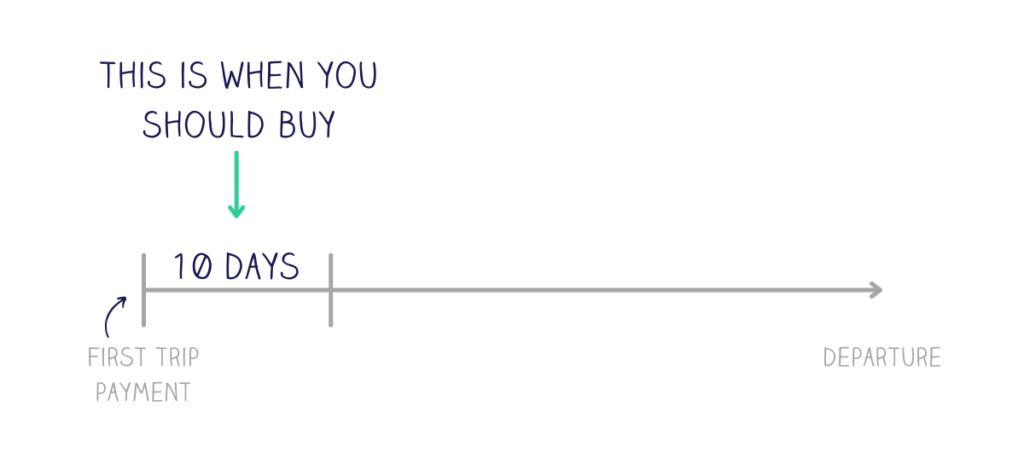

My rule: Buy travel insurance within 10 days of your first trip payment.

Some travel insurance coverage is time-sensitive. This means you need to purchase your plan soon after your initial trip deposit. This period of time is different for each company. The lowest is 10 days, and some companies are as high as 30 days.

This is why 10 days is the safest goal for you. No matter which company, 10 days will put you within that time-sensitive window.

What coverage is time-sensitive?

Cancel For Any Reason coverage (also known as CFAR) is an optional coverage with some plans. Every company that sells CFAR requires you to purchase within their time frame. If you try to purchase after this time period, you will not be able to.

Pre-existing condition coverage is time-sensitive. This does not cost extra, but many companies will cover this if you purchase at the right time.

What is not covered by travel insurance?

The biggest misunderstanding with travel insurance coverage is what’s covered for trip cancellation. Many people think “I have insurance, so I can just cancel”– but it’s not that simple. There is also a list of exclusions in your travel insurance policy, and any claims related to these are not payable.

Trip cancellation coverage

The most important thing here is understanding the list of covered reasons for trip cancellation. It includes common events like sickness, injury, death, house fire, weather, hurricanes, terrorism, jury duty, called for military service, and more.

But it is not listed, it will not be covered (unless you have Cancel For Any Reason coverage).

Everything is spelled out in the policy certificate. It describes what is covered, who is covered, and all of the details.

Exclusions

Your policy certificate also has a list of exclusions. It explains situations where any claim is not payable. This list includes things like injuries sustained while on drugs, professional sports, hazardous activities like mountain climbing, suicide, acts of war, and more.

Is travel insurance worth it?

Many travelers ask, “Is travel insurance really necessary?”.

Most travelers that buy insurance say it’s for “peace-of-mind” because they are spending a lot of money on their trip, and/or going abroad and want to be safe.

Consider the amount of money you have invested in your trip and ask if you’re willing to lose that if you cancel. Many things can happen, but the most common is someone getting sick right before your departure. A sick child, parent, traveling companion, or even business partner can make you cancel. If that happens without insurance, you could lose all of your trip expenses.

Also consider your destination. If you leave your home country, you should always have emergency medical and evacuation insurance. Your insurance from home probably won’t cover you, and even if it does the limit might be low and they won’t cover evacuation.

Are these insurance companies trustworthy?

Yes. All companies featured in our search engine are reputable, and are regulated by the Division of Insurance.

Zero Complaint Guarantee

Every policy purchased through CoverTrip comes with a unique Zero Complaint Guarantee.

If you are unhappy with how your travel insurance claim is handled, Squaremouth’s team of licensed claims adjusters will investigate your case and mediate with the provider on your behalf. If the complaint is not resolved to Squaremouth’s satisfaction, they will remove the provider from the website and stop selling their policies.

Travel Insurance FAQs

Yes. Every travel insurance plan we sell comes with a Free Look period. This means you have a certain number of days to examine your coverage, and still have the ability to cancel for a full refund. This period is different for each company, but 10 days is a safe standard to keep in mind.

Travel insurance covers sudden and unforeseen events such getting sick, a death in the family, a hurricane, theft, a house fire, and more. Therefore, if you already know you will need to file a claim you cannot purchase travel insurance to cover it. The list of exclusions also includes losses as a result of war, professional sports, some hazardous activities, drug/alcohol abuse, etc.

Yes, travel insurance covers cruises. Some companies market “cruise” plans, which is a collection of coverages that are important to cruise travelers.

Yes, sort of. In the past insuring cruises insurance was popular but not necessary. For example, up to 70% of cruisers buy insurance, vs just 40% of regular travelers. But Covid has made travel insurance a requirement in many ports-of-call so it is necessary.

Yes. I recommend you purchase within 10 days of your first trip payment. If you do this, you have the most options and access to coverages like Cancel For Any Reason and Pre-existing Conditions. You can purchase travel insurance right up until departure, but if something happens that causes a cancellation, you need to already have coverage purchased.

No. Many credit cards advertise “travel insurance”, but it is very limited coverage. It can be ok for smaller trip expenses, but it lacks in comprehensive coverages like medical and evacuation. It’s better than nothing, but if you want to insure your investment get a separate travel insurance policy.

Worldwide Trip Protector- FlexiPAX

- Coverage for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 6 hour common carrier delay

- Children 17 and under included free

- Unique family-friendly coverage for cancellation if your school year is extended unexpectedly.

- Great for: Overall best plan. This plan has better coverage in almost areas, unique coverages, and is priced competitively.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.