3 Tips to Protect that ‘Wave Season’ Deal for Real Cruise Savings

24 January 2014

The cruise industry calls it ‘wave season and it typically takes place between January and March, when the majority of cruises are booked for the coming year.

It’s hard to tell whether travelers are merely savvy or simply tired of the winter snow and need something to look forward to, but this time every year cruise lines showcase free upgrades and more to tempt travelers.

Cruise experts have all sorts of information for consumers who want to know how to get the best deal on their cruise vacation, but we’re here to tell you how to insure that trip so you really do enjoy the savings. After all, if you lose all that money you are spending due to something you can’t predict when you buy the cruise package, it’s not really saving at all.

Despite the savings travelers get during wave season, a cruise vacation is still one of the more expensive trips most travelers take, and when you can’t afford, or don’t want, to throw that investment away an insurance plan is a great way to protect it. Otherwise, the big concern for cruise travelers is medical emergencies.

All cruise ships have some medical facilities and staff on board, but a medical emergency that needs more skilled treatment than a general practitioner will have to be handled off-ship. Since the cruise line has a schedule to keep they aren’t in a position to divert an entire boat to drop a patient off somewhere where they can get medical treatment. Plus, onboard treatment isn’t cheap (nothing on board is cheap by our non-cruise standards.

Let’s review some of the best ways you can protect that wave season cruise deal.

1. Total Up the Trip Costs and Buy Trip Cancellation

When you’re trying to dig your car out from under two feet of snow in January, you can’t imagine canceling your cruise in June. But kids, parents, and in-laws get very sick and need your help; jobs are lost or changed; traffic accidents occur on the way to the airport. In short, life happens.

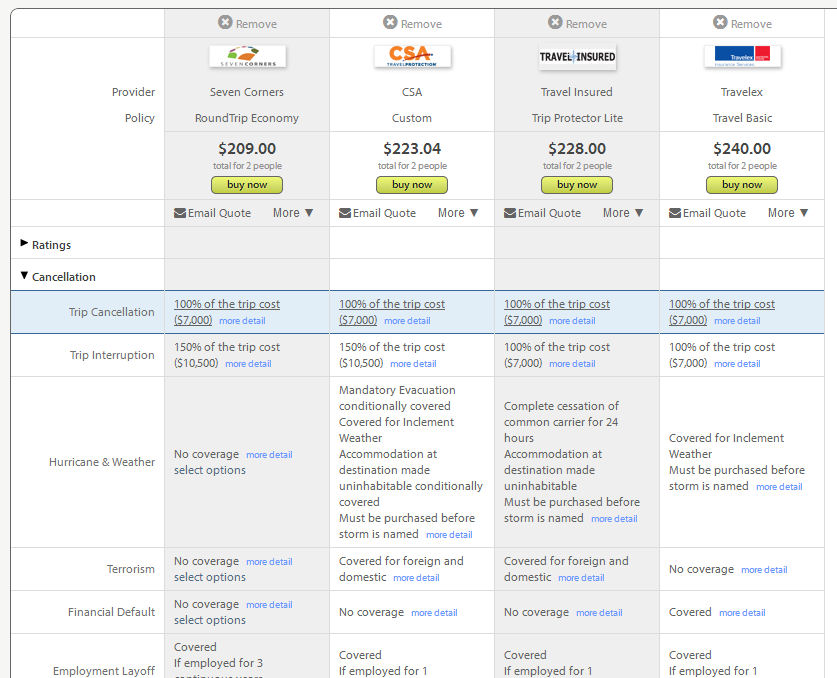

If you buy a 12-day Paris to Prague anniversary cruise for you and your wife in June, you could easily be spending $7,000 for a really nice vacation, including the cruise, airfare, lodging, transportation and more. Depending on your ages, the cost of insuring that trip for cancellation, interruption, emergency medical, evacuations, and more

It’s important to note that all your pre-paid travel costs have to be totaled up so you can insure the entire trip because insuring just a portion of the trip isn’t allowed by the travel insurance companies. Still, paying the extra couple hundred bucks to be sure you can get all your investment back is usually worth it for most travelers – especially cruise travelers.

2. Check your Itinerary Against your Health Insurance Coverage

If you have employer-sponsored health insurance coverage, you may have an HMO or PPO and both have network limits that define how far a person can travel from their home and/or work and have coverage. The in-network costs are far lower than the out-of-network costs due to a number of factors and no one really understands. The key for travelers is finding out what coverage they have outside their network.

If you are on Medicare, you coverage stops at the border of the U.S. so you will have no coverage in a foreign country – even Canada and Mexico – without a supplemental plan that covers you abroad or a travel insurance plan. The same is true for most employer-sponsored health insurance coverage and the health insurance plans available now on the health care marketplace. None of the health insurance plans have emergency medical evacuation coverage, so that’s an important factor to consider as well.

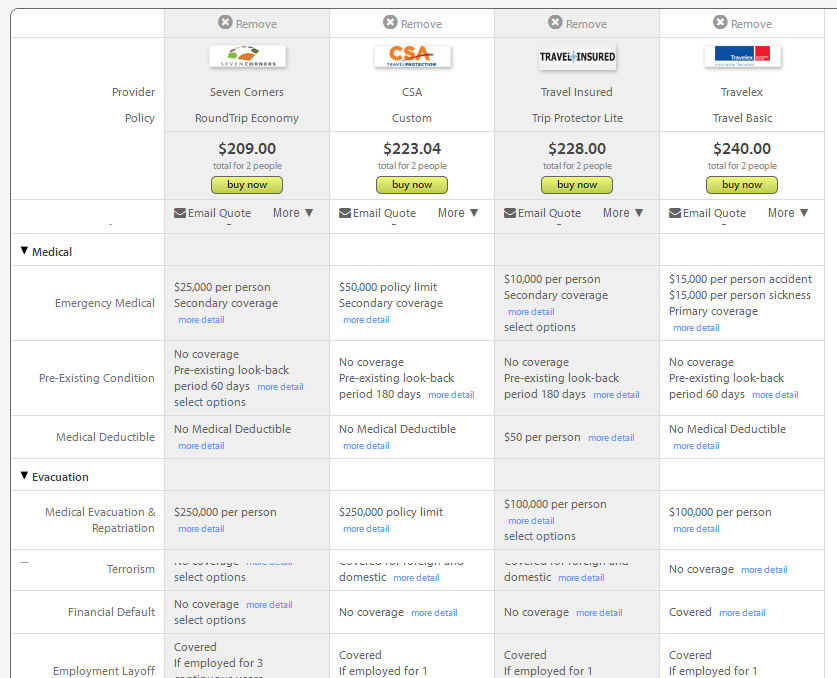

If you have little or no coverage for medical emergencies on your cruise, then a trip to the onboard doctor for a cut on your head after you tumbled down a steep stairwell could mean adding a few hundred or more onto your credit card bill. Using the same plans as an example, the medical insurance coverage you’d have with a travel insurance plan could be:

In some situations – depending on the medical emergency you encounter – the coverage listed above may not be enough, but this is something each traveler has to determine for themselves. The key with a travel insurance plan, however, is that you have choices. You can choose to get more medical insurance coverage (for a slight bump in the premium), cover pre-existing medical conditions, and more.

See How Much Travel Medical and Evacuation is Enough for more details.

Anytime a traveler leaves their health insurance coverage area, any accident they encounter could mean a very expensive bill has to be paid but travel medical insurance can cover those expenses instead.

3. Factor in the Risk of Other Losses

While the risks on a cruise ship are really pretty controlled, there are a few other potential problems a traveler could encounter on a cruise ship, including:

- Being robbed or mugged – see 8 Tips to Avoid Being Robbed on a Cruise

- Getting sick from a virus that’s traveling around the ship – see Avoiding Norovirus on Vacation – it’s Not Just a Cruise Ship Problem

- Being attacked in a port of call – see 3 Port of Call Risks to Avoid on Your Next Cruise

- Being in a cruise disaster – see 8 Items to Pack in Your Cruise Ship Emergency Kit

One other thing that a traveler could encounter on their way to their cruise ship departure is a missed connection. If an early hurricane in one part of the country grounds flights and causes you to miss your cruise ship departure, your cruise travel insurance plan will help you find alternative transportation to catch up to your cruise as soon as possible so you don’t miss the entire trip. No ‘travel protection’ package sold by the cruise line offers that coverage.

See our review of cruise insurance for more information – including the best plans for cruise travelers.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.