How Much Travel Medical and Evacuation is Enough?

3 September 2012

Two recent, and devastating, media stories:

- One of a young woman injured falling off a boat and hospitalized in Croatia

- One of a man left in a German hospital after a head injury

are prompting this post.

In at least one of the cases, the injured traveler will be held liable for at least $20,000 in foreign medical costs. In both cases, the traveler did not have travel insurance that covered emergency medical evacuations and in both cases, their families and friends are trying desperately to raise the funds necessary to transport them home and to cover their medical care.

Unfortunately, these are not uncommon stories. They happen frequently and just as unfortunately, those travelers and their families could have been spared the heartache and fear with a very affordable travel insurance plan.

Some travelers get bogged down by determining how much coverage is enough, so let’s review the following steps to determine how much coverage you need on any trip you take in the future.

Determine how far you’re traveling

The cost of medical care and emergency medical transport is determined by a limited set of factors: the patient’s condition and their location.

More specifically, the treatment for a patient with massive internal injuries on remote mountain in South America is going to cost more than a patient with food poisoning in Cozumel. In the latter example, medical treatment could be received locally. In the first example, the insured would likely have to be airlifted to a nearby hospital where initial treatment to stabilize their condition could be administered before a second evacuation could take them to their home country and back into their own health insurance network.

Either way, if you’re going a long way or to a place where medical care is very expensive (like the U.S. and Canada), you’ll need a little more coverage.

Determine the coverage you have already

Some U.S. health insurance plans have coverage outside the U.S., but most don’t. While Medicare doesn’t cover seniors for medical treatment outside the U.S. borders, many Medicare Supplement plans have some coverage for emergency medical treatment.

How do you determine the coverage you already have? You’ll have to pull out your plan’s description of coverage and read it.

If you can’t figure out whether you have coverage in the country you want to visit, call your insurance company and ask them specifically how much you will have to pay for an emergency room visit with a broken nose in the country you want to visit. You’ll have a much better idea what coverage you need after a question like that.

Determine what medical care will be available

In some countries, medical care – even for foreigners – is covered by the taxpayers of that country, although some of those countries are currently considering requiring travelers to show evidence of medical coverage upon entering the country. Most countries expect the patient to bear at least some, if not all the cost and that’s where medical insurance comes in handy.

So, how does a traveler determine the availability and quality of medical care where they will be traveling?

The US State Department’s country-specific pages are a great source of this type of information. For example, here’s what it says about Mongolia’s medical care:

Medical facilities in Mongolia are very limited and do not meet most Western standards, especially for emergency health care requirements. Many brand-name Western medicines are unavailable. The majority of medical facilities are located in Ulaanbaatar. Medical facilities and treatment are extremely limited or non-existent outside of Ulaanbaatar. Specialized emergency care for infants and the elderly is not available. Doctors and hospitals usually expect immediate payment in cash for health services.

Good to know ahead of time: When you receive medical care in a foreign country, you are typically required to pay the bill immediately (often before treatment). This is true even with some travel insurance plans although some providers will pay the medical facility directly.

Define your personal risk

Not all travelers are alike. Some travelers are content to lie on comfortable chairs by the pool and read books; others need the adrenaline rush of jumping off high bridges on bungee cords. Of course, there are all the ranges in between as well as those one-off situations where a traveler decides to try something new on a whim.

Here are some of the risk factors to take into account:

- Will you be participating in activities considered ‘high-risk’, like hang-gliding, para-sailing, skiing, SCUBA diving, and more?

- Will you be traveling to a remote location where medical care is extremely limited?

- Do you have any pre-existing medical conditions that could be affected by your travel?

- Are you traveling to a location known to have specific medical risks, like malaria, yellow fever, dengue fever, and more?

- Are you carrying medications that may be difficult to replace in a foreign country if lost or stolen?

- Are you older or in frail health?

Combine your trip factors with common sense

Now that you’ve thought through your trip factors, let’s combine those with a little common sense. Lots of travel insurance policies will give you high limits, but you may not need that much coverage and every dollar of coverage means less in your pocket on your trip.

When it comes to emergency medical evacuations, not many medically necessary evacuations cost more than $100,000 or $200,000. For example, a medically equipped air transport for a traveler who suffered a heart attack and fell into a coma in China to return to New York recently cost $183,000. In this case, it was a long-distance trip with a patient who had a known medical condition. According to the website set up to help one of the injured travelers mentioned at the start of this post, the cost for her medical transportation from Croatia to Toronto is reported to be $93,550 U.S.

When it comes to travel medical care, severe injuries or illnesses will of course cost more than mild ones so depending on your age, your current health, and the risks where you are traveling you may need a little more or a little less. Luckily, you don’t have to leave this decision up to a judgement call or a coin toss.

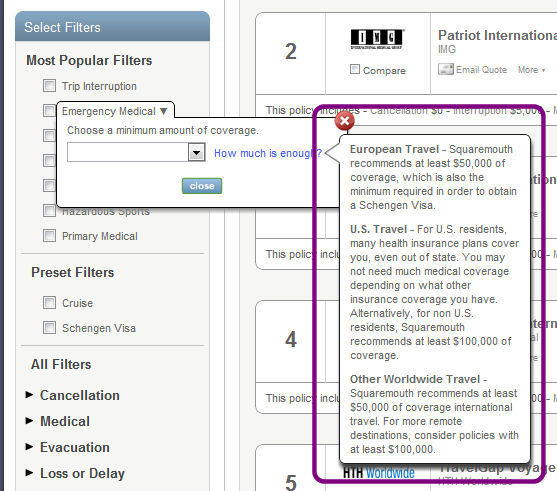

Our travel insurance comparison tool gives you some guidance:

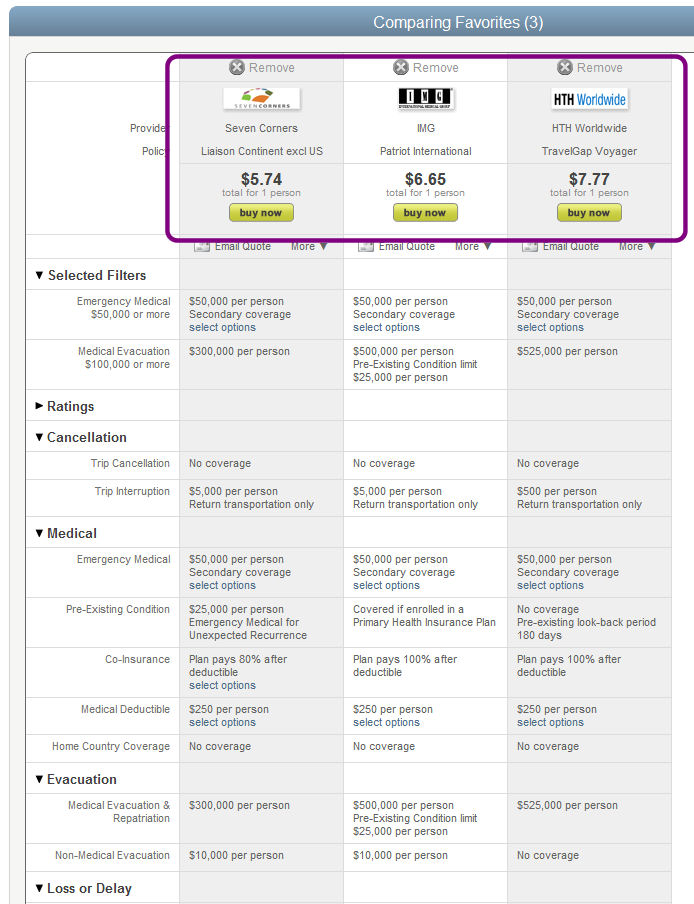

Just to make the point about the cost of travel insurance plans, we used these trip factors:

- One 38-year old traveler from California

- Visiting Chile for one week

- No pre-existing medical conditions, trip cancellation, or hazardous activities

and found many plans with at least $50,000 in medical coverage and at least $100,000 in evacuation for less than $10.00:

Wherever you go, having travel medical and evacuation coverage is simply a no-brainer. As they say, don’t leave home without it.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.