Editor Review of Seven Corners

The Good: Seven Corners travel insurance offers a wide variety of travel medical policies for international travelers – both U.S. and non U.S. citizens. Many of their plans offer flexible limits and your choice of deductible. Plans for students, seniors, missionaries, and business travelers.

The Drawbacks: Website is intended for travelers looking for travel medical insurance for international trips.

The Bottom Line: Seven Corners has specialized in international medical insurance for years. They have a wide variety of products perfect for short- and long-term international stays. They also provide a number of highly comprehensive package travel insurance plans with their RoundTrip products.

Company Information

Company Name | |

|---|---|

| US Travel Insurance Association Member | Yes |

| Refund Policy | 10-day Free Look Period |

| Travel Insurance Plans | Package plans RoundTrip – most popular plan RoundTrip Choice RoundTrip Economy RoundTrip Elite Travel Medical plans Disciple Missionary Medical Inbound Guest Inbound Immigrant Liaison Continent Liaison International Liaison Majestic Liaison Silver Liaison Student Liaison Worldwide Reside Reside Prime Wander Frequent Traveler Specialty plans Bordercross Worldwide |

| Company Contact Information | Seven Corners Inc. 303 Congressional Boulevard Carmel, IN 46032 1-800-335-0611 317-575-2659 Fax |

| Policyholder Questions | 1-800-335-0611 |

| Travel Assistance/Emergencies | Inside US/Canada: 1-800-690-6295 (toll free) Outside US/Canada: call operator & connect to 1-317-818-2808 (no charge) |

About Seven Corners Travel Insurance

Seven Corners has specialized in keeping travelers safe from a medical perspective since 1993. Their travel medical plans remain some of the best in the industry. Seven Corners remains an innovator in the industry by delivering the first ever medical tourism protection plan to protect patients from the high costs of medical care due to complications of treatment received overseas.

Students, seniors, and missionaries can find useful, comprehensive travel medical plans. In addition, guests and recent immigrants to the U.S. can obtain major medical coverage to protect against financial losses due to accidents and illnesses during their stay. Worldwide medical plans, and an evacuation plan that includes optional medical coverage is also available for frequent travelers.

In addition to their travel medical plans, Seven Corners offers a number of travel insurance package plans to suit most travelers.

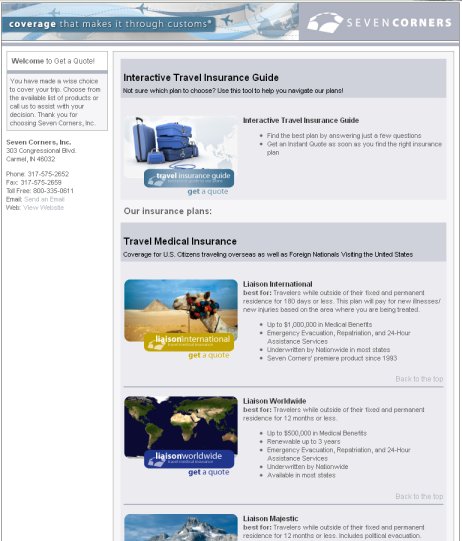

Their website is well organized and easy to use – organized by travel or traveler type, so you can quickly find plans to meet your needs. Traveler’s resources are available right in the site navigation. The site includes travel warning feeds, useful case studies, client testimonials, real life travel stories, and much more.

Optional Coverage Available in Seven Corners Plans

- Optional hazardous sports rider available for hang gliding, skiing, motorcycle riding, and more.

- Travelers can add optional medical coverage to the medical evacuation plan – Liaison Traveler – to round out that coverage.

Highlights of Seven Corners Travel Insurance

- Many plans cover both U.S. and non U.S. citizens and there are many trip length options.

- Plans offer access to Well Abroad, an online resource for travelers.

- Easy to find and easy to understand plan pricing.

Seven Corners Travel Insurance Plans

Package Plans

RoundTrip Economy

Ideal for the traditional traveler who wants affordable but comprehensive coverage

Affordable coverage for trips up to 90 days, this plan delivers all the expected coverages and offers a few options to round out the coverage. Coverage for pre-existing medical conditions available if plan is purchased within 10 days of initial trip deposit. Purchase the optional collision damage waiver if you will be renting a car on your trip.

RoundTrip – most popular plan

Designed for ‘every traveler’, this plan offers all the expected coverages at comfortable limits

With comfortable plan limits for medical and evacuation, this plan ensures that travelers are safe from common travel-related risks. It includes AD&D, but the plan limits are relatively low (consider the optional add-on if that’s a concern). Optional collision damage rider available for up to $35,000 in rental car coverage.

RoundTrip Choice

For the discriminating traveler looking for excellent protection and some additional options

Featuring the highest plan limits, this package delivers all the expected travel insurance package coverages. Although the AD&D limits are relatively low, you can add an optional add-on to enhance the coverage. Purchase within 21 days of initial trip deposit to have access to a number of important plan benefits, including coverage for pre-existing medical conditions, supplier default, and severe weather. Optional collision damage waiver available.

RoundTrip Elite

Intended for travelers who require the ultimate in travel insurance protections

Designed for the traveler who wants the highest protection available, this plan delivers high plan limits and a number of optional add-ons to round out the coverage. Coverage for pre-existing medical conditions, bankruptcy, and severe weather in base plan if purchased within 21 days of initial trip deposit. Purchase an optional collision damage waiver if you plan to rent a car on your trip.

Travel Medical Plans

Disciple Missionary Medical

International medical protection for traveling missionaries for up to 12 months

This coverage is intended to provide medical coverage for healthy missionaries traveling outside their home country for up to one full year. Provides the added reassurance of security evacuation and full medical coverage for terrorist acts. Available to citizens of all nations.

Inbound Guest

Health insurance protection for visitors to the U.S. from other countries

Ideal for foreign nationals on temporary visits to the U.S. for business, leisure, or to study. Trips from five days up to six months can be accommodated with this short-term travel medical plan. Plan is limited to non U.S. citizens.

Inbound Immigrant

Proper health insurance coverage protecting new immigrants to the U.S.

An affordable yet comprehensive medical insurance plan for new immigrants to the U.S. This plan is available to non U.S. citizens in the U.S. for business, school, or to immigrate. It protects individuals and families from the high costs associated with medical emergencies, accidents, and illnesses.

Liaison Continent

Comprehensive, short-term, major medical for those leaving home for up to six months

This plan is ideal for travelers headed outside their home country for trips of 180 days or less. This is a short-term major medical plan with multiple coinsurance options, home country coverage, and a few package-like benefits to ease travel issues. Available for U.S. and non U.S. citizens.

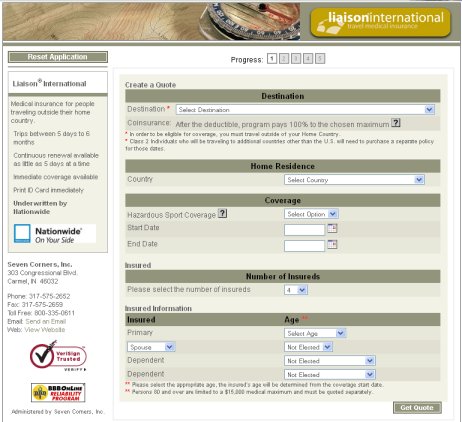

Liaison International

Short-term major medical insurance for travelers away from home up to six months

With relatively high coverage for the plan benefits, this short-term coverage is major medical insurance for travelers who will be away from their permanent residence for 180 days or less. Flexible coverage that lets you choose the medical maximum and deductible. Extend your coverage to your home country for illnesses and injuries incurred while traveling.

Liaison Majestic

Major medical for individuals and families traveling outside their home country

This is major medical for those traveling outside their home country – U.S. citizens and non U.S. citizens alike – for up to 12 months (renewable up to three years). Flexible coverage that lets you choose the medical limit and deductible amount. Includes political evacuations and a few package-like benefits: lost baggage and trip interruption reimbursement.

Liaison Silver

Excellent, comprehensive travel medical coverage for active travelers over age 50

Travel medical insurance is a must – especially when traveling abroad. This plan covers individuals and families protecting them from the high cost of global medical care. It offers a few package-like benefits as well. Low premiums for dependent children and grandchildren.

Liaison Student

Comprehensive major medical coverage for students of all countries who are studying abroad

Ideal coverage for students, including their spouse and children, who are traveling outside their home country for educational purposes. Annual coverage that is renewable as long as the insured remains eligible (up to age 65). Covers illnesses, injuries, mental and chiropractic care just as any other health insurance plan – also includes evacuation, repatriation, and coverage for other travel medical concerns.

Liaison Worldwide

Worldwide major medical for U.S. citizens headed abroad and non U.S. citizens coming in

This plan offers comprehensive, annual, major medical insurance for U.S. citizens traveling outside their home country and non U.S. citizens coming into the U.S. Trips between five days and up to 12 months (renewable up to three years) for those age 65 and younger.

Reside

Necessary worldwide medical coverage for up to one year of travel medical benefits

Providing basic worldwide medical coverage with scheduled benefits and predetermined plan limits, this plan ensures that U.S. and non U.S. citizens have medical coverage when traveling outside their home country. Coverage for those up to age 74, and up to two kids under age 9 are free with two covered parents.

Reside Prime

Minimum one-year purchase for comprehensive worldwide medical coverage

Ideal for individuals and families traveling for at least one year and up to three outside the U.S. and Canada, this plan delivers U.S.-style medical coverage with your choice of deductible for medical treatment anywhere in the world.

Wander Frequent Traveler

Evacuation and medical coverage for those who frequently travel outside their home country

Ideal for frequent travelers who want consistent medical and evacuation coverage when traveling outside their home country. Covers all trips of 30 days or less throughout the year and includes some package-like benefits such as lost baggage, trip interruption, and full travel assistance services.

Specialty Plans

Bordercross Worldwide

Unique coverage for medical complications due to medical tourism

The first plan of its type, this plan addresses the unique needs of medical tourists – that is, people traveling to other countries to receive medical care they either can’t get or can’t afford in their home country. This plan provides coverage for medical complications abroad and after you return home. It includes cancellation benefits as well as medical evacuation benefits.

Screenshots of Seven Corners website