Editor Review of Global Underwriters

The Good: Global Underwriters is an established international medical insurance provider with a good number of travel medical plans for U.S. and non U.S. citizens. They also provide a high-limit AD&D, a group medical plan, and an employee kidnap protection plan for high-profile companies.

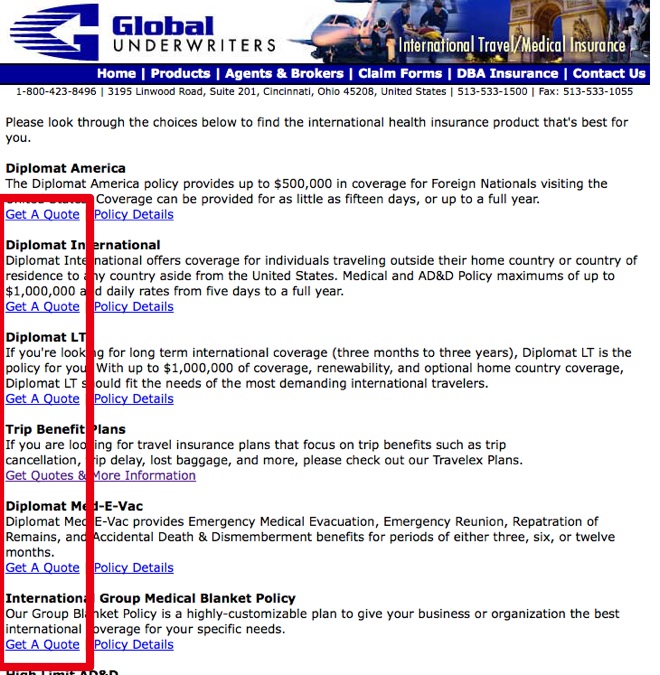

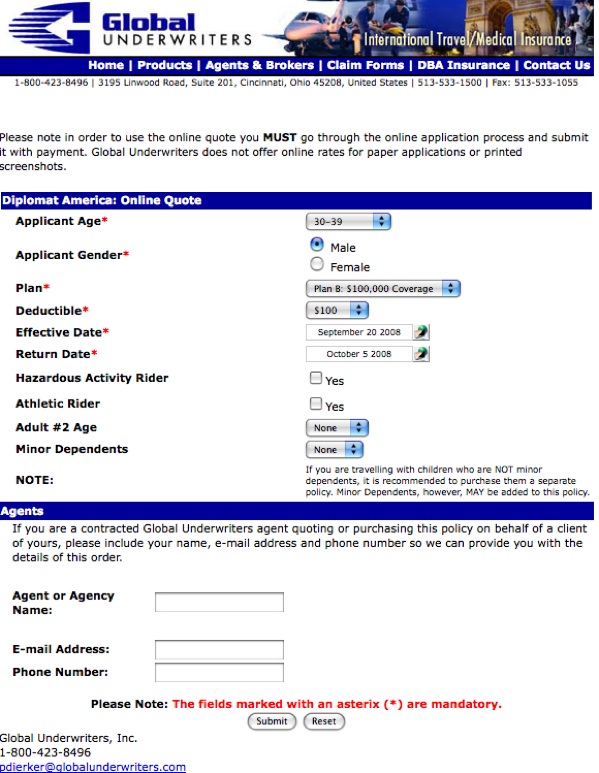

The Drawbacks: Global Underwriters is focused on travel medical and travel accident plans, so they do not directly provide any package plans. Their website is outdated and difficult to use and you will have trouble reviewing the plan details. None of the Global Underwriters plans offer coverage for pre-existing medical conditions, and their emergency dental limits are very limited.

The Bottom Line: Global Underwriters is a specialist in the medical insurance field. They have several travel medical insurance plans for U.S. and non U.S. citizens, a travel accident plan, and a specialty plan for high-profile employees to guard against kidnapping, extortion, and ransom demands.

More about Global Underwriters Insurance

Apart from many travel insurance providers, Global Underwriters is entirely focused on international travelers and their medical insurance needs. In today’s uncertain and troubled political environment, it is important to have medical insurance and accident coverage that will provide protection wherever you travel, especially outside your home country where your traditional coverage may be in effect.

Global Underwriters is well established with 45 years of experience in the insurance industry and it offers comprehensive and economical international health and accident insurance products to protect you, your family, or your employees as they travel on business, vacation, or reside in a foreign country. Their website also includes special coverage options for defense contractors involved in overseas efforts and even kidnap and ransom insurance, when necessary.

The Global Underwriter website lets you get plan-specific details, obtain a quote, contact their support representatives, and obtain plan-specific claim forms. Many of their plans are backed by 24-hour travel assistance support for those unexpected situations that can occur while traveling. Most plans come with a variety of plan maximums and some are age-rated.

Optional Coverage Available in Global Underwriters Plans

- Optional hazardous activity coverage for activities like SCUBA diving, snow and water skiing, mountain climbing, and more, which are typically excluded from coverage.

- Optional athlete coverage for participation in amateur club or interscholastic sports.

- Optional home country coverage for incidental home country trips up to two months per 12 months of coverage (limits apply).

- Additional AD&D and additional war risk coverage available in Diplomat International.

Highlights of Global Underwriters Insurance

- Well established company experienced in medical insurance products.

- Some highly specialized plans for international workers and defense contractors.

Global Underwriters Travel Insurance plans

Travel Medical plans

Diplomat America

High protection for foreign nationals visiting the United States

This package provides up to $500,000 in coverage for non U.S. foreign nationals visiting the United States. Coverage can be extended for as little as 15 days and up to an entire year. A variety of deductible options are available to you. Coverage is available to individuals and their families.

Diplomat International

Coverage for individuals traveling outside their home country

This package provides coverage for individuals traveling outside their home country to any country other than the U.S. Policy maximums of up to $500,000 can be selected and coverage can be extended for as few as 15 days up to a full year. Coverage is available to individuals, his or her spouse, and their unmarried dependent children up to 18 years in age.

Diplomat LT

For those long-term international trips, this is the policy for you

This package provides up to $1,000,000 in coverage for non U.S. foreign nationals and includes options to renew and optional home country coverage, if necessary. The policy is intended as long-term coverage and trips can range from three months to three years. Coverage is available to individuals, his or her spouse, and their unmarried dependent children up to 18 years in age.

International Group Medical (blanket policy)

A highly customizable international medical insurance plan for your business

International travel and even relocation have become common for many businesses and their employees, but multinational employers face unique risks. This blanket policy is ideal for multinational businesses, organizations, universities, and missionary groups sending their employees or members overseas. The policy is flexible and can be customized to meet your needs.

Travel Accident plans

High Limit Accident Insurance

High limit accidental protection for international travelers

Accident hazards are sufficiently unique to merit extra insurance protection in certain circumstances. This package provides from $500,000 to $20,000,000 in international accident benefits. Unlike medical policies, this protection is targeted compensation for specific losses of limb, sight, hearing or speech. It is intended for business and professional firms, educators and students, war correspondents and military families, tour groups participating in hazardous sporting activities.

Specialty plans

Corporate Kidnap, Ransom, and Extortion Insurance

An employer-focused plan to protect against financial losses due to employee kidnapping

This employer plan protects against financial loss due to kidnapping, extortion, or ransom demands while providing crisis management support services. This is a highly focused plan useful for high-profile organizations whose employees handle large amounts of cash or work with sensitive information or technologies.

Screenshots of Global Underwiters Website