Editor Review of MH Ross/TripAssure

The Good: MH Ross has been in the travel insurance industry for over 50 years. All their plans automatically include a pre-existing medical condition waiver if you purchase your plan within 15 days of your initial trip deposit. With just four travel insurance package plans, it’s easy to find the coverage limits you need quickly, get a quote, and purchase online. Their travel assistance services, provided by One Call, are extensive and include business and concierge services in addition to a number of emergency travel assistance services. Their plans also come with online medical records access through Global Xpi service.

The Drawbacks: MH Ross plans are only available to residents of the U.S. No travel medical or medevac-specific plans.

The Bottom Line: MH Ross has been in the industry longer than many travel insurance providers. They have an excellent rating and good customer service policies. Their plans, and their website, are easy to understand. Their enhanced travel assistance services is provided by a third-party company: One Call Worldwide Travel Services Network.

About MH Ross Travel Insurance

Founded in 1953, MH Ross is an award-winning organization that has been in the travel insurance industry since 1961. MH Ross offers four comprehensive travel insurance package plans, which makes it very easy to compare, review, and decide.

Optional Coverage Available in MH Ross Plans

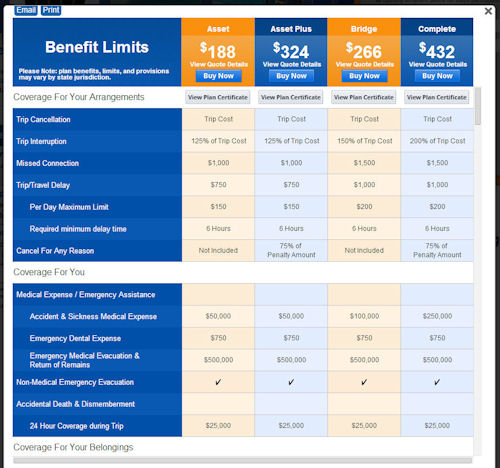

- Air flight AD&D benefits available at $100,000 ($10 per person), $250,000 ($25 per person), and $500,000 ($50 per person) limits.

- Rental car damage protection available for up to $35,000 ($7 per day).

- Extended Personal Property coverage ($15 per person) for electronics (laptops, cell phones, etc.).

- Sports Upgrade Pac provides medical costs if injured while participating in a covered sport and $1,000 in rental fees or non-refundable tickets, green fees, equipment rentals, lessons ($25 per person).

Highlights of MH Ross Travel Insurance

- Available to residents of the U.S.

- Plans include automatic exclusion for pre-existing conditions if purchased within 15 days of your initial trip deposit date.

- Asset and Asset Plus have flat rates for children (17 and younger), for just $14 or $25 regardless of trip cost.

- Asset Plus includes ‘cancel for any reason’.

- All plans include unique online medical record service through Global Xpi.

- All plans include non-medical emergency evacuations (up to individual plan limits).

- All plans include emergency dental treatment due to injury up to $750.

- All plans include primary medical, hurricane warning benefit, cancel for work reasons, normal pregnancy and school year extensions.

- All plans have both 24-hour and common carrier AD&D (individual plan limits apply).

- Trip cancellation can occur up to your scheduled departure date for a covered reason.

- Additional trip interruption benefits (up to individual plan limits) for accommodation and transportation expenses if you or your traveling companion are hospitalized.

MH Ross Travel Insurance Plans

Package Plans

Asset Plan

Basic travel insurance protection with a few extras to round out the coverage

This plan is ideal for value-conscious families and individuals who want to protect their vacation dollars. Flat rate premiums for children age 17 & younger. Waiver of pre-existing conditions automatic if purchased within 15 days of initial trip deposit. This plan is available for U.S. Citizens up to age 65; trips up to 60 days and trip cost of $50,000

Asset Plus Plan

Comfortable coverage for your primary travel concerns

This plan is ideal for individuals and families who want to protect their vacation dollars without paying for an unnecessarily high-priced plan. Automatic pre-existing medical condition exclusion waiver and ‘cancel for any reason’ are included with early purchase (within 15 days of initial trip deposit). This plan is available for U.S. travelers up to age 65 and trips up to $50,000.

Bridge Plan most popular plan

Higher benefit levels with excellent coverage for travelers

Travel insurance protection with comfortable benefit limits and a number of highly desired extras including non-medical emergency evacuations and 24-hour AD&D. Early purchase of this plan qualifies travelers for the pre-existing medical condition waiver (purchase within 15 days of initial trip deposit). For trips up to $100,000 (maximum for age 81 and above is $15,000).

Complete Plan

A good plan for the luxury trip or cruise traveler

This plan provides exceptional comprehensive coverage with high limits for standard travel emergencies along with ‘cancel for any reason’ and a pre-existing medical condition waiver included in the base plan (when the plan is purchased within 15 days of initial trip deposit). For trips up to $100,000 (maximum for age 81 and above is $15,000).

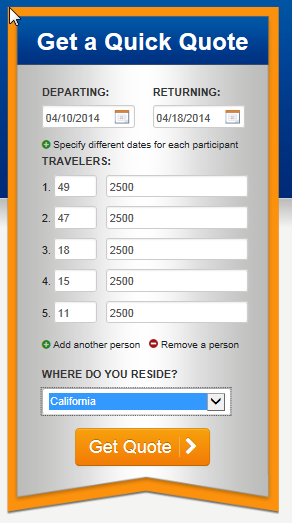

Screenshots of MH Ross Website