The 3 Best Travel Medical Insurance Plans: Updated November 2024

If you want to enjoy peace of mind while traveling outside your home country, you need the best travel medical insurance beforehand. This will protect you in case of emergency for you and any companion travelers. And in this article, we’re going to share the 3 best policies with you.

These plans provide emergency medical coverage for travelers who are leaving their home country. They cover medical emergencies and emergency evacuations. Your health insurance from home might not cover you abroad – which is why this is such an important consideration. You need to have travel medical coverage when going abroad.

Not only are we going to unveil the 3 best travel medical insurance plans currently available. But, we’re also going to cover everything you need to know about this type of plan in general, including:

- Why it is essential

- What the benefits are

- What exactly is covered

- How it works

- What it costs

- How to get your plan set up

But, let’s start with the main topic at hand – what are the best travel medical insurance plans available for travelers right now?

The Three Best Travel Medical Insurance Plans

We have three plans we’re going to discuss – but the ideal pick for you will depend on a number of factors, including your trip destination, desired coverage, age, and more. With that said, I recommend Seven Corners for your travel medical insurance plan. They have specialized in this coverage since 1993, insuring thousands of international travelers every year. Here is why they’re so great:

Best Plan for Most Travelers

Travel Medical

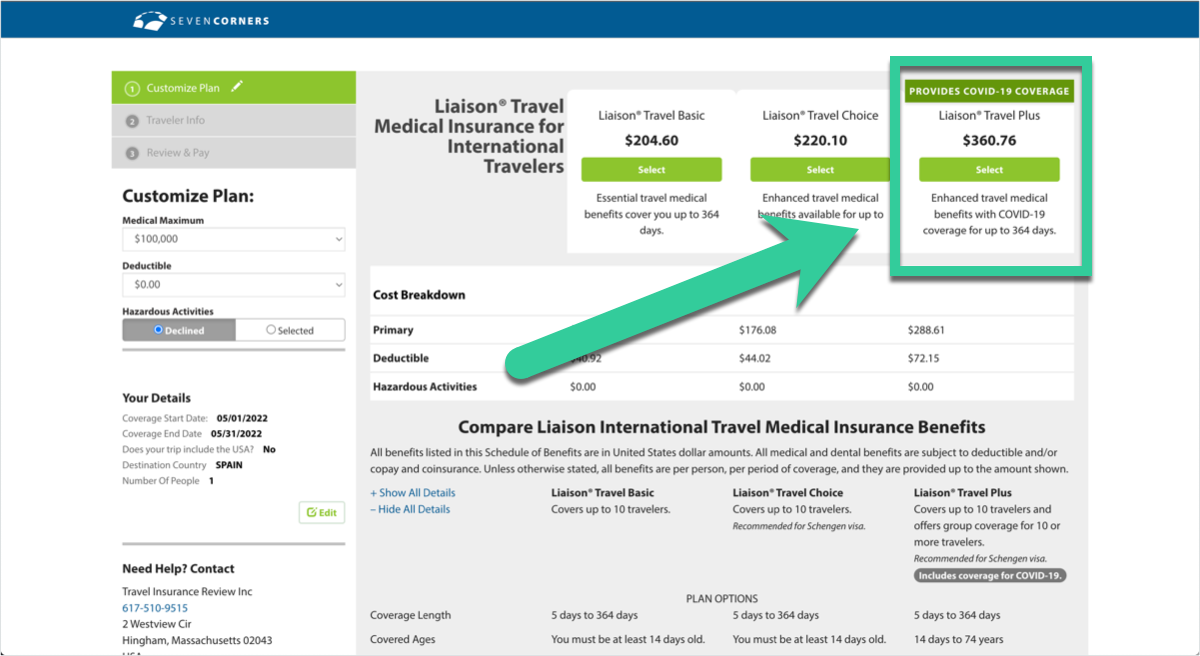

- Optional Covid coverage if you opt for the Plus plan

- Available to US travelers going abroad

- Available to international travelers traveling abroad (including USA)

- Several options for medical coverage limit

- Available for groups

Key benefits of Travel Medical include:

- Designed for all travelers so it’s easy to buy: It can cover trips as short as 5 days, and as long as 364 days. US citizens can use it abroad. International travelers can visit the US. And international travelers can visit internationally.

- Designed for all ages to anyone can buy: Covers travelers as young as 14 days old, and up to 99 years old.

- Can be extended which gives you flexibility: If your plans change, you can extend your coverage up to 364 days.

- Choose your coverage limit let’s you find the right plan for your budget: With medical limit options from $50,000 to $1,000,000 (depends on age) there’s a plan for every budget

- Online quote and purchase so it’s less stress for you: Their website makes choosing a plan, selecting coverage, and checking out very simple so you can get insured stress-free.

Best Plan for Students

Student Travel Medical

- Optional Covid coverage if you opt for the Student Plus plan

- Available to US students going abroad

- Available to international students traveling abroad (including USA)

- Several options for medical coverage limit

You may buy a student insurance plan for yourself, your spouse and dependents if you are:

- A full-time student, faculty member, or scholar;

- Involved in full-time educational or research activities;

- Traveling outside your home country; and

- At least 12 years old and younger than 65 years of age.

Key benefits of Student Travel Medical include:

- Choose your coverage limit let’s you find the right plan for your budget: With medical limit options from $50,000 to $1,000,000 (depends on age) there’s a plan for every budget

- Online quote and purchase so it’s less stress for you: Their website makes choosing a plan, selecting coverage, and checking out very simple so you can get insured stress-free.

Best Plan for Visitors to the USA

Explore North America Plus

- Includes Covid coverage

- Designed for long-term visitors to the USA.

- Available to Non-US citizens visiting the United States

- Available to Non-US residents visiting the United States

- Several options for medical coverage limit

Key benefits of Explore North America Plus include:

- Perfect for parents visiting the USA long-term: Your visiting family members can enjoy US healthcare while visiting you in the United States.

- Choose your coverage limit let’s you find the right plan for your budget: With medical limit options from $50,000 to $1,000,000 (depends on age) there’s a plan for every budget

- Online quote and purchase so it’s less stress for you: Their website makes choosing a plan, selecting coverage, and checking out very simple so you can get insured stress-free.

Best Single-Trip Insurance Plans

If you want the comprehensive coverage of cancellation insurance, you will want Trip Insurance.

You can compare travel insurance plans from all companies, get quotes, and buy online here on CoverTrip.

You might also check out:

- Best Cruise Travel Insurance Plans

- Best Family Travel Insurance Plans

- Best Cheap Travel Insurance Plans

- Best Group Travel Insurance Plans

All travel insurance companies include a free look period with a refund that lets you review the plan documentation. If you decide you need something a little different, you can make changes to your policy or cancel it for a refund (minus a small fee).

Travel Medical Insurance Purchasing Guide (What Travelers Need To Know)

Imagine this: You are on a bike tour in the remote countryside of Italy. Your husband takes a fall and has some minor scrapes…but he also has a heart attack.

You need to find the closest good hospital. You also need an ambulance to get you there. Once at the hospital, he needs immediate care for the heart attack.

Afterwards, you need special transportation on a medically-staffed flight to get back home.

Throughout all this you are dealing with language barriers. And questions about paying hospital bills.

- Without travel medical coverage: You could be stuck with all hospital costs, ambulance costs, and surgery bills. This could cost you tens of thousands of dollars. Plus, medical transport back home on a special flight could be $50,000 or more. And that’s assuming you found a reputable medical facility in the first place.

- With travel medical coverage: First thing you do after immediate care is call the 24/7 assistance line. They help find the best hospital near you and arrange transport if necessary. They overcome any language barriers and arrange your care, guaranteeing payment if necessary. They cover the bills, even that expensive med-flight back home.

What is travel medical insurance?

Summary: Travel health insurance is temporary medical insurance that covers you on your trip. It pays for emergency medical expenses and emergency evacuations. It also provides 24/7 assistance to help you.

When you leave your home country, your insurance might not travel with you. That means once you leave, you are on your own.

Even if your plan does cover medical expenses abroad, they won’t cover the evacuation. Medical evacuations include an ambulance ride, an airlift from a remote location, or transport back home.

Plus, those relying on Medicare are definitely out of luck. Medicare does not cover you abroad.

Other names for travel medical insurance include: International Medical Insurance, International Travel Insurance, or Worldwide Medical Insurance.

Organizations that recommend travel medical insurance

Center for Disease Control (CDC)– “If you are planning an international trip, you should consider getting travel insurance to cover yourself against accidents or illness while you’re abroad.”

U.S. Department of State– “The U.S. government does not provide medical insurance for U.S. citizens overseas. We do not pay medical bills. You should purchase insurance before you travel”

World Health Organization– “Travelers are strongly advised to travel with comprehensive travel insurance as a matter of routine. Travelers should be aware that medical care abroad is often available only at private medical facilities and may be costly. In places where good-quality medical care is not readily available, travelers may need to be evacuated in case of accident or illness.”

In addition, there are horror stories of foreign hospitals refusing to let you go until you have paid your bill.

Bottom Line: You need travel medical coverage when you leave your home country.

How does travel medical insurance work?

You can buy travel medical insurance online and get instant confirmation of coverage. You can get emergency medical coverage with a standalone policy. Or you can get it as part of comprehensive trip insurance.

You have two options to get travel medical coverage:

- Option A You can buy a standalone Travel Medical Insurance policy. This would cover medical emergencies, evacuation, and assistance services. This is for travelers not worried about losing trip costs if you need to cancel.

- Option B You can buy comprehensive Trip Insurance. This covers cancelled trips, interrupted trips, baggage, delays, and medical emergencies and evacuations. This if for travelers that want to protect their trip costs.

What about a doctor exam, though? You do not need a medical examination to buy travel insurance. Travel health insurance is a temporary policy and issued immediately. They investigate claims afterwards. If you have a claim, the company will confirm the issue occurred during the policy coverage period.

Why travel medical insurance is essential

No one, no matter where you’re traveling, wants to get sick or injured on vacation. It can be one of the most devastating mishaps that can occur on a trip. Add to the fear factor, the cost and trying to navigate a foreign medical system and you’ve got a real problem.

Travel health insurance pays “reasonable and customary” expenses like:

- Emergency transportation to a hospital

- Doctor’s bills

- Hospital and operating room costs

- X-rays, treatments, test, and anesthesia

- Medications

You wouldn’t want to pay those out-of-pocket expenses. That’s why there’s international travel medical insurance. It’s peace of mind. It’s essential for any traveler outside their home country.

The benefits of travel medical insurance

The primary benefit of international travel medical insurance is knowing you won’t have to pay for your medical care in a foreign country.

In addition to the medical benefits, other benefits of travel medical insurance include:

- Evacuation and repatriation back to your home country

- Translation services

- Family visits to your bedside

- Return of minor children

These are just a few of the wide range of benefits in these plans.

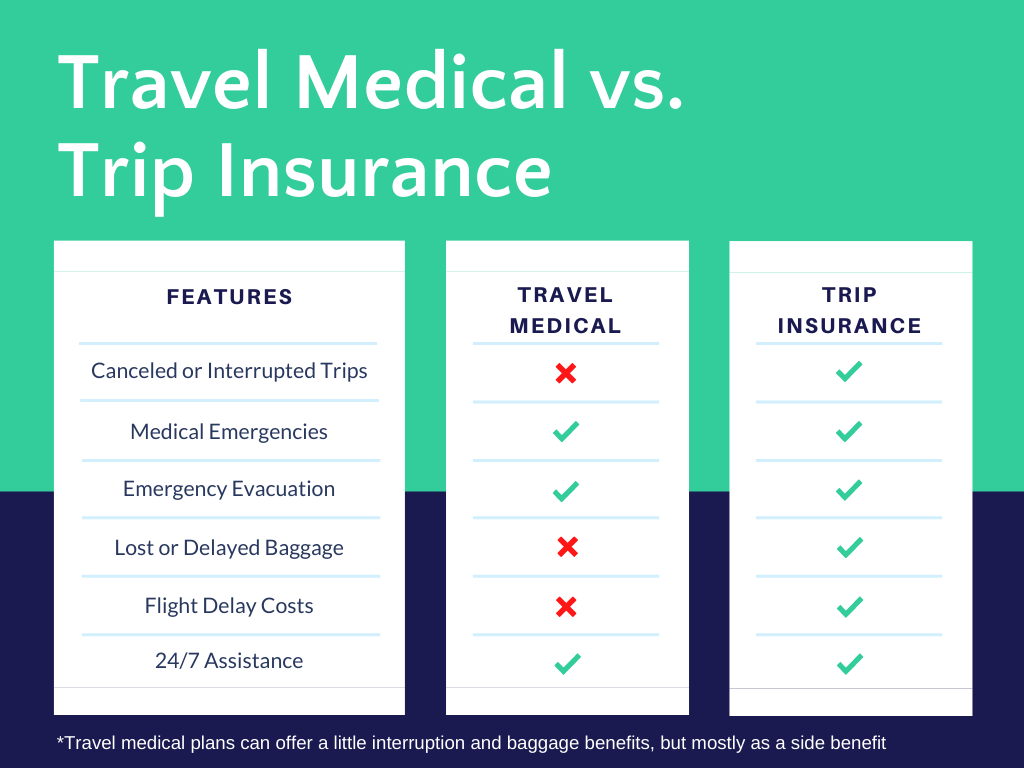

How is travel medical insurance different from comprehensive trip insurance?

Many people don’t understand which type of travel insurance they need. Your cruise line offers you a plan. The booking website offers you a plan. A travel agent offers you a plan.

Plus, there are different names for everything: Trip insurance, travel insurance, international insurance, vacation insurance, cruise insurance, travel medical insurance.

Let’s make it simple.

Your choice is between Travel Medical Insurance and Trip Insurance. But what is the difference? We’ll make that simple too.

Difference #1: Travel Medical Insurance focuses on medical emergencies while Trip Insurance focuses on cancellation coverage

With a Travel Medical plan, the focus is on emergency medical and evacuation costs.

If you are abroad and have an accident or become ill, it would cover medical costs for you. Emergency dental treatment is usually included too.

Emergency medical evacuations will get you out of a remote area and transported to a place where you can receive proper medical care. It would also move you back home if necessary.

If there’s a death on the trip, repatriation coverage will ensure the body is properly transported home or to a funeral home nearby.

With Trip Insurance, you are concerned with losing all your pre-paid money if you need to cancel your trip.

Trip Insurance covers cancelling for an illness or injury. It also covers hurricanes, a home fire, jury duty, job loss, and more. It covers cancellations for unexpected and unforeseen reasons.

It also covers interrupted trips when your vacation is cut short for some reason. It also covers lost or stolen bags, flight delays, baggage delays, and more.

Finally, it covers medical emergencies and evacuation, like travel medical insurance.

When most people think of “travel insurance”, they think of cancellation coverage and not wanting to lose money of they need to cancel.

Note: Travel medical plans often include some coverage for baggage loss or interrupted trips. But the coverage limits are much lower than with Trip Insurance so it is not considered a primary coverage.

Travel Medical can also have Accidental Death and Dismemberment (AD&D) coverage. It can have term life benefits which are paid regardless of any coverage you may have back home for a covered injury. This coverage can fill out your life insurance benefits and provide extra coverage for you or your family in the case of a serious accident.

Difference #2: Travel Medical insurance is cheaper than trip cancellation insurance

With Trip Insurance, the cost is based on the trip cost that you are insuring. If you insure a $10,000 cruise, it will cost more than insuring a $250 flight. Even the best cruise travel insurance plans will cost more than a travel medical plan.

Since standalone Travel Medical doesn’t cover cancellations, the cost is much lower.

Bottom line: If you are getting insurance to cover your whole trip (cancellation, baggage, delays, etc), you will also get travel medical coverage included. See our picks for best travel insurance here.

If you don’t want cancellation coverage and are leaving your home country, you should get a Travel Medical insurance plan.

What does travel medical insurance cover?

Here is the coverage in a Travel Medical plan. This coverage is also in Trip Insurance, but with the addition of cancellation coverage.

- Reimbursement for unexpected medical costs due to emergency medical care.

- Reimbursement for unexpected dental costs due to an accident.

- Advance payments to medical facilities and help to get emergency medical transportation when you are injured.

- Coordination of and payment for emergency medical evacuation services, including medical care providers to attend to you until you reach an appropriate medical care facility.

- Travel accident benefits like Accidental Death & Dismemberment (AD&D) to help take care of you or your family if you are seriously injured or killed while traveling.

- Emergency travel assistance services to help you locate a local an appropriate medical facility to care for your medical needs and those of your family.

Examples of why would you need emergency medical coverage

- You’re on a long business trip and get food poisoning.

- You trip on a cobblestone street and break a tooth.

- You are traveling ahead of your church missionary group to organize housing and get in a traffic accident.

- You are traveling in a foreign country with your children and get injured in a fall.

- You want the assurance of having travel medical assistance services to help you in an emergency.

Examples of travelers that might buy it

Here are some examples of the types of travelers that buy travel medical insurance:

- US Citizens going abroad A typical health insurance plan doesn’t extend outside the U.S. borders. So if you’re traveling abroad, you’ll want travel medical coverage. You need it for illnesses and injuries that happen outside your health insurance coverage zone.

- Visitors to the US When family members visit from abroad and stay a few days or even a year, they should have coverage for their stay.

- Students studying abroad When your kids leave home for a semester abroad, they’re required to have emergency medical coverage.

- Business travelers working overseas If your health insurance plan doesn’t extend outside the U.S. (and most don’t), you’ll need some medical and evacuation coverage if you’re working overseas.

- Expats and long-term travelers Not only does your own health insurance (even Medicare) fail to cover you outside the U.S., if you are visiting multiple countries, you’ll want to ensure you have the same coverage no matter where you travel.

- Missionaries and foreign aid workers Just because you are traveling to make a difference in someone else’s life doesn’t mean something bad can’t happen to you. Be sure you are protected in case you have a medical emergency or need to be evacuated to safety.

What are the types of travel medical plans?

Travel medical plans come in three types:

International Medical insurance for a single trip (Most popular)

This type of plan is for a single trip, and covers the length of you vacation..

Multi-trip International Medical (Annual plan)

This annual plan provides the coverage of international medical insurance on an annual basis. It would cover multiple trips throughout the year.

Visitor Travel Medical insurance

These plans offer long-term for visitors to the USA. This might include visiting family members and parents, staying with you in the USA.

What Does Travel Medical Insurance Cost?

One of the main questions travelers have is in regards to what the travel medical insurance cost is. Medical plans are priced based on age, trip length, and coverage amount.

This usually adds up to a few dollars per day, so it is a very budget-friendly way to get emergency medical coverage abroad.

Here is sample pricing to show you the difference between Travel Medical and Trip Insurance.

Sample Trip: 2 travelers, both 44, traveling abroad for 1 week. The Travel Medical plan quote is for $100,000 medical coverage. The Trip Insurance is for a $3,000 trip with medical coverage of $100,000.

| Travel Medical Insurance | Trip Insurance |

| $47 | $158 |

Both prices are the total for 2 travelers for the entire week.

The difference is the Trip Insurance quote would reimburse you for cancelled trips, cover baggage, delays, and more. Trip insurance usually costs 4-10% of the insured trip cost, so these plans can often be in the hundreds of dollars.

Travel medical plans are meant for the overseas traveler seeking medical insurance protection outside their home coverage network.

How to buy travel medical insurance

The best overall plan for travel medical insurance is Travel Medical from Seven Corners. This plan has the option for Covid-19 coverage, has adjustable limits, is affordable, and is from a reputable company.

Time needed: 10 minutes

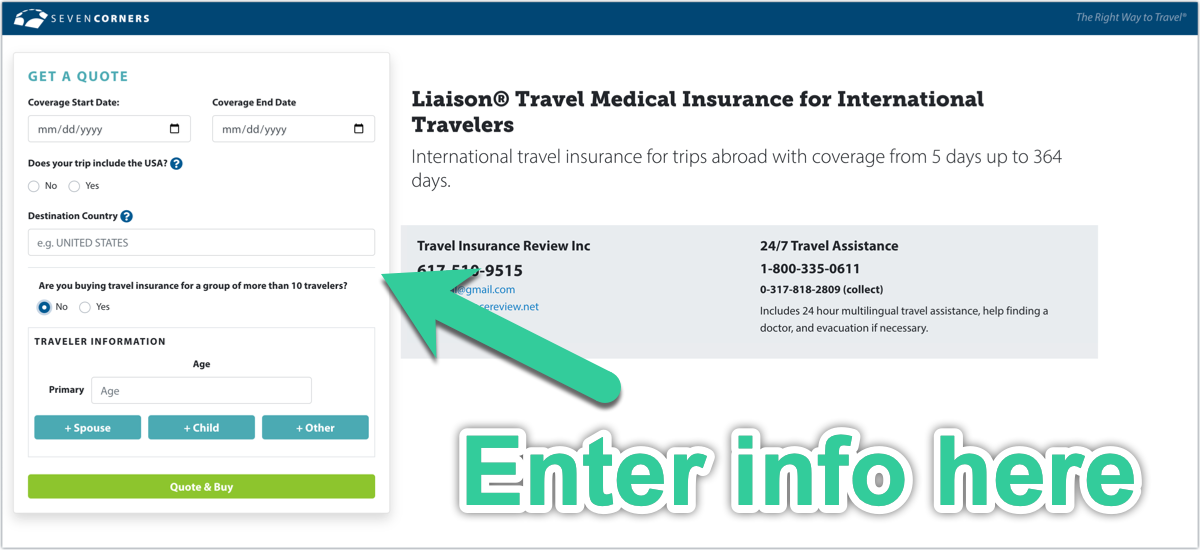

How to buy travel medical insurance

- Gather your information

You will need the dates of travel and traveler ages.

- Use the link below to start your quote

You can use this link or the button at the bottom to start your quote. Note: I am a licensed agent and will earn a commission if you purchase using my links. This does not cost you anything, the insurance company pays this.

- Enter your trip information

If you need help on the form, click the blue ? marks for a hint.

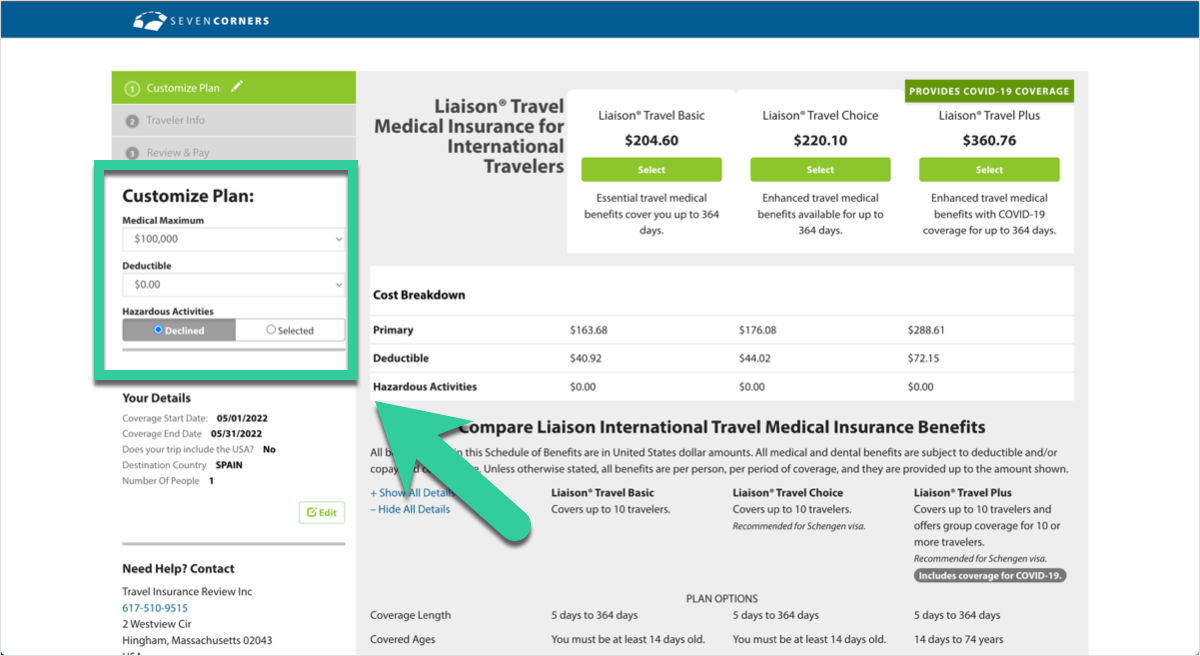

- Select options (optional)

You can choose a different medical maximum limit and deductible amount. You can also opt in for Hazardous Activities coverage. All of these changes will adjust the cost

- Select a plan and purchase for immediate coverage

When you find the best plan, click Select to enter your contact and payment information. You will receive an immediate confirmation by email

Travel Medical

- Optional Covid coverage if you opt for the Plus plan

- Available to US travelers going abroad

- Available to international travelers traveling abroad (including USA)

- Several options for medical coverage limit

- Available for groups

Travel Medical Insurance FAQs

We’ve covered virtually everything you need to know about medical trip insurance. Now, you probably know what you need to get started selecting your policy. But if you still have a few questions, there is a good chance we cover them below in this section of the most frequently asked questions:

Primary Coverage pays first before any other coverage you might have. This means you claim directly with the insurance company, and they handle it from there.

Secondary coverage pays after any other insurance has been used. So, if you did have some coverage from your home health insurance, that would be used first, then travel medical would cover after that.

If you have secondary coverage and no other insurance provides coverage, your secondary coverage essentially becomes primary coverage.

The main benefit to Primary is the ease of claims as there are fewer companies to deal with.

No. Since it does not cover your trip cost like travel insurance, travel medical insurance is not expensive at all. Even older travelers, where age rating causes premiums to increase, can have travel medical coverage for $5-$10 per day of travel.

Travel medical insurance covers medical emergencies, evacuations, and a few other things like baggage.

Trip insurance (also called Trip Cancellation or simply Travel Insurance) covers cancellations, interruptions, baggage, delays, medical, evacuation, and more.

(Medicare never does), and even if it does it would not cover evacuations.

If you are leaving your home country, get travel medical insurance by itself with a Travel Medical Insurance policy, or as part of a comprehensive Trip Cancellation Insurance policy.

Anytime you leave your home country you should have travel medical coverage…either through a Travel Medical plan of a Trip Insurance plan.

You can purchase travel medical insurance right up until your trip departure, and as soon as when you make your first trip plans.

Yes, but keep in mind it only covers new incidents. If you are on your trip and have an emergency, you cannot buy travel insurance and expect it to be covered.

If possible, seek any immediate care you need to prevent further injury. Once reasonably possible, contact the insurance company’s 24/7 assistance line for further help.

You should contact the claims number as soon as reasonably possible and they will advise about any special procedures you need to do.

Final Thoughts On The Best Travel Medical Insurance Plans In 2022

There you have it – the best travel medical insurance plans in 2022. Here are some closing thoughts we want to leave you with to help you take the next step:

- Travel Medical is best for most travelers

- Student Travel Medical is best for student travelers

- Explore North America Plus is best for visitors to the USA

- Travel medical plans are focused on medical and evacuation coverage

- Because this type of plan doesn’t include many package plan benefits, it’s usually very affordable

- This type of coverage is crucial for those traveling abroad to protect against financial losses due to an illness or injury

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.