Editor Review of GeoBlue

The Good: GeoBlue focuses on travel medical and international health insurance plans. They offer a number of plans for short-term trips for vacations, business trips, and more, multi-trip travel, and long-term travel for those living abroad. GeoBlue has a network of physicians and health care providers who can see a traveler on short notice.

The Drawbacks: The GeoBlue plans are only for U.S. citizens and only those heading outside their home country on their trip.

The Bottom Line: A leading provider of international health insurance since 1997, GeoBlue is the trade name for Worldwide Insurance Services. All travel health plans are offered in cooperation with Blue Cross Blue Shield. Their plan are ideal for U.S. travelers who are heading abroad and want dedicated support for their emergency and non-emergency health care needs abroad.

Company Information

Company Website | |

|---|---|

| US Travel Insurance Association Member | Yes |

| Refund Policy | 10-day Free Look Period |

| Travel Insurance Plans | Single Trip Travel Medical Plans Voyager Essential Voyager Choice Multi-Trip Travel Medical Plans Trekker Essential Trekker Choice Single-Trip Group Travel Medical Plans Voyager Essential Group Voyager Choice Group Expatriate Worldwide Medical Plans Xplorer Essential Xplorer Premier Navigator for Crew Navigator for Missionary |

| Company Contact Information | GeoBlue Travel Insurance One Radnor Corporate Center, Suite 100 Radnor, PA 19087 USA Outside the U.S. 1.610.254.5850 Inside the U.S. !.855.481.6647 Fax: 610.482.9953 customerservice@geo-blue.com |

| Policyholder Questions | Collect Calls Accepted +1.610.254.8771 Inside the U.S. 1.800.257.4823 |

| Travel Assistance/Emergencies | Collect Calls Accepted +1.610.254.8771 Inside the U.S. 1.800.257.4823 |

About GeoBlue Travel Medical Insurance

GeoBlue is the trade name for the international health insurance products of Worldwide Insurance Services – an independent licensee of the Blue Cross Blue Shield Association. Since 1997, Worldwide Insurance Services has been dedicated to helping travelers and expats gain access to quality healthcare around the world. GeoBlue’s products combine mobile technology and worldwide healthcare expertise for global travelers. GeBlue has an innovative approach with contracted doctors and hospitals in almost every country of the world.

GeoBlue offers short-term and long-term travel medical insurance plans for individuals, families, and groups who are traveling overseas for vacations, for business, and even to live long-term. Their plans are focused on the travel medical and international health coverage needs of travelers – both emergency and non-emergency health care. Their plans are U.S. licensed and regulated. Seniors up to age 84 can get coverage for their global travel.

The GeoBlue website is easy to browse and you can quickly select the plans to compare by selecting your trip type: single-trip or multi-trip. The website includes destination health profiles to help travelers determine their health risk.

Optional Coverage Available in GeoBlue Travel Medical Plans

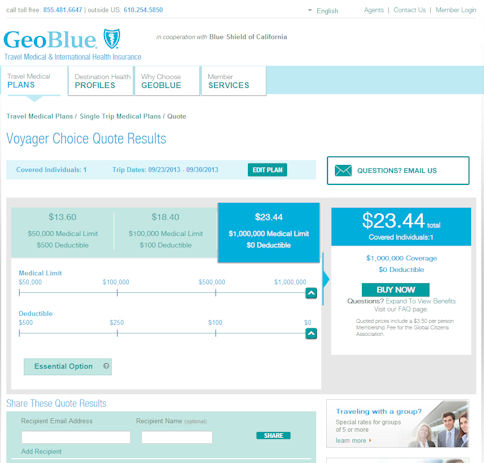

- Choices available for maximum international medical coverage limits and deductibles – this can save a traveler money.

- Their global health and safety travel resources include doctor search, drug translation guide, medical term translation databases, as well as health and security news alerts.

Highlights of GeoBlue International Health Insurance

- Their global health and safety travel resources include doctor search, drug translation guide, medical term translation databases, as well as health and security news alerts.

- Cashless appointment scheduling so travelers don’t have to pay first then make a claim to be reimbursed.

- Vacations, business trips, and even living abroad can all be covered with their international health plans.

GeoBlue Travel Medical and International Health Insurance Plans

Single Trip Travel Medical Plans

Voyager Essential

Essential travel medical coverage for trips up to 181 days – includes downhill skiing and SCUBA

International health insurance for U.S. residents with a primary health insurance plan who are under age 75 and traveling outside the U.S. This plan does not require the insured to have a health insurance plan, so it’s ideal for travelers heading abroad in between jobs. This plan covers 100% of medical, surgical, and prescription costs you choose the maximum benefit and deductible amount. No hospital pre-certification penalty.

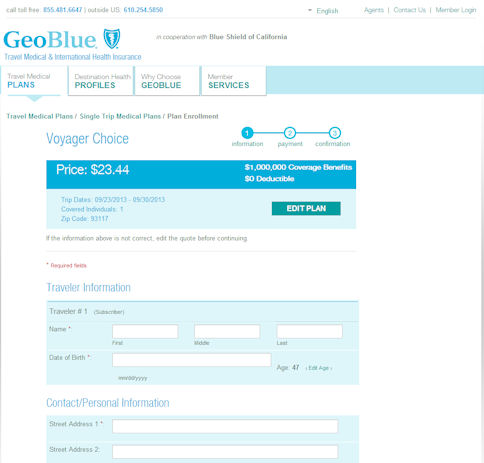

Voyager Choice

An international health plan for those up to age 84 with pre-ex included

International health coverage for U.S. citizens who have a primary health insurance plan, are under age 85, and traveling outside the U.S. Includes pre-ex if purchased early and automatically includes downhill skiing and SCUBA accidents (with some ocnditions). Traveler choses the maximum medical benefit limit and deductible. No hospital pre-certification penalty.

Multi-Trip Travel Medical Plans

Trekker Essential

Multi-trip health and evacuation insurance for unlimited travel all year long for travelers up to age 85

Highlights include coverage for pre-existing conditions (with some conditions) and unlimited trips over a 12-month period. This plan requires the insured to have a primary health plan and individual trips must be no longer than 70 days. No hospital pre-certification penalties.

Trekker Choice

Multi-trip annual travel medical and evacuation insurance with pre-ex for travelers up to age 85

Covering 100% of medical costs after your deductible and up to your choice of plan limit, this travel medical plan requires the traveler to have a primary health plan. Comprehensive travel medical coverage for trips up to 70 days long and covering an unlimited number of trips in a 12-month period.

Single Trip Group Travel Medical Plans

Voyager Essential Group

Comprehensive travel medical coverage for groups of travelers up to age 74

Highlights of this plan include coverage for pre-existing conditions and the traveler chooses medical limits and deductibles. This plan also includes a 10% discount on groups of 5 or more. Insured travelers are required to have a primary health plan.

Voyager Choice Group

Travel medical coverage for trips up to 6 months in length and travelers up to age 85

This plan includes a 10% discount on groups of 5 or more. Travelers enjoy coverage for pre-existing conditions and trips can be as long as 6 months. This plan requires the traveler to have a primary health plan, and you choose the medical deductibles and plan limits.

Expatriate Worldwide Medical Plans

Xplorer Essential

Worldwide coverage (excluding the U.S.) and offering 50% savings

This coverage offers unlimited annual and lifetime medical maximums with no waiting period for preventative care. Pre-ex covered with the right coverage. Illness and injury due to terrorist acts also covered. Plan can be used on its own or with a domestic health care plan.

Xplorer Premier

Customized medical coverage with a choice of deductible and prescription benefits

This plan offers a customized solution – you define the deductible and prescription benefits. Pre-ex covered with the right coverage. Choose providers in or out of the network. Portable plan – you can take it with you when you return home.

Expatriate Crew International Health Plan

Navigator for Crew

Worldwide medical coverage for crew members – ideal for those working on ships

Unlimited annual and lifetime maximum and a choice of deductibles. Sail boat racing and alcohol-related injuries are covered.

Expatriate Missionary and Volunteer International Health Plan

Navigator for Missionary

Worldwide medical coverage for missionaries, aid workers, and volunteers

Ideal for career missionaries, but also for aid workers and volunteers. Choose from a range of deductibles and rates. No waiting period and pre-existing conditions covered (with conditions). Can be used on long-term furlough back home.

Screenshots of GeoBlue Travel Medical Insurance Site